How to Sell Crypto in Norway in 2022

Cryptocurrency in Norway today is fast on the rise and retail investors are crypto world, often with minimal research into the market risk. Before buying or selling crypto, it’s crucial to know your options! Selling crypto through the wrong platform is a surefire way to lose funds and end up disappointed in your profit margin.

How to Sell Crypto in Norway

Today, we dive into identifying valuable crypto assets and reputable crypto exchanges, how to sell your crypto for fiat currency and other crypto assets, and just how much of the crypto income you owe to the government in taxes. Let’s begin!

How to Determine the Value of Crypto

We may never find a financial market more responsive to news and demand/supply laws than the crypto markets. However, other factors such as the technology behind a cryptocurrency, its safety, total market capitalization, and mass adoption are great indicators of a valuable virtual currency.

A simple comparison of your crypto of interest with other cryptocurrencies using some of these factors will provide relevant insights into your investment decision.

Asset Taxation of Bitcoin and Other Crypto Currencies

Cryptocurrencies in Norway are taxable.

According to the Norwegian Tax Authority, Bitcoin, and other virtual currency, is an asset for tax for which the Norwegian tax laws must apply

Given the legal status of virtual currency in Norway and the recognition of Bitcoin and other cryptocurrencies by the Norwegian government, it is classified as an asset, and income from crypto trading is taxed at 22%.

Some platforms such as Kryptosekken help calculate your crypto taxes.

What to Consider if You Plan to Sell Crypto

Taxes are the main consideration when selling crypto.

The Norwegian Tax Authority, under the Ministry of Finance, would expect you to declare the bitcoin investment and crypto-assets you own as wealth, as well as declare your crypto profits as income.

In a recent press release, the supervisory authority issued a stern warning to Norwegian citizens stating that they risk paying additional tax if they are found wanting of evasion.

So, be sure to give unto Caesar what belongs to Caesar when you sell your digital assets for fiat.

The Best Exchanges to Sell Your Crypto in Norway

Let’s say you’ve invested wisely and you’re starting to see healthy returns. Where do I sell my Bitcoin for cash?

Look no further. We’ve curated a list of reputable exchanges where you can sell your crypto for fiat (such as the Norwegian Krone) or other cryptocurrencies in Norway.

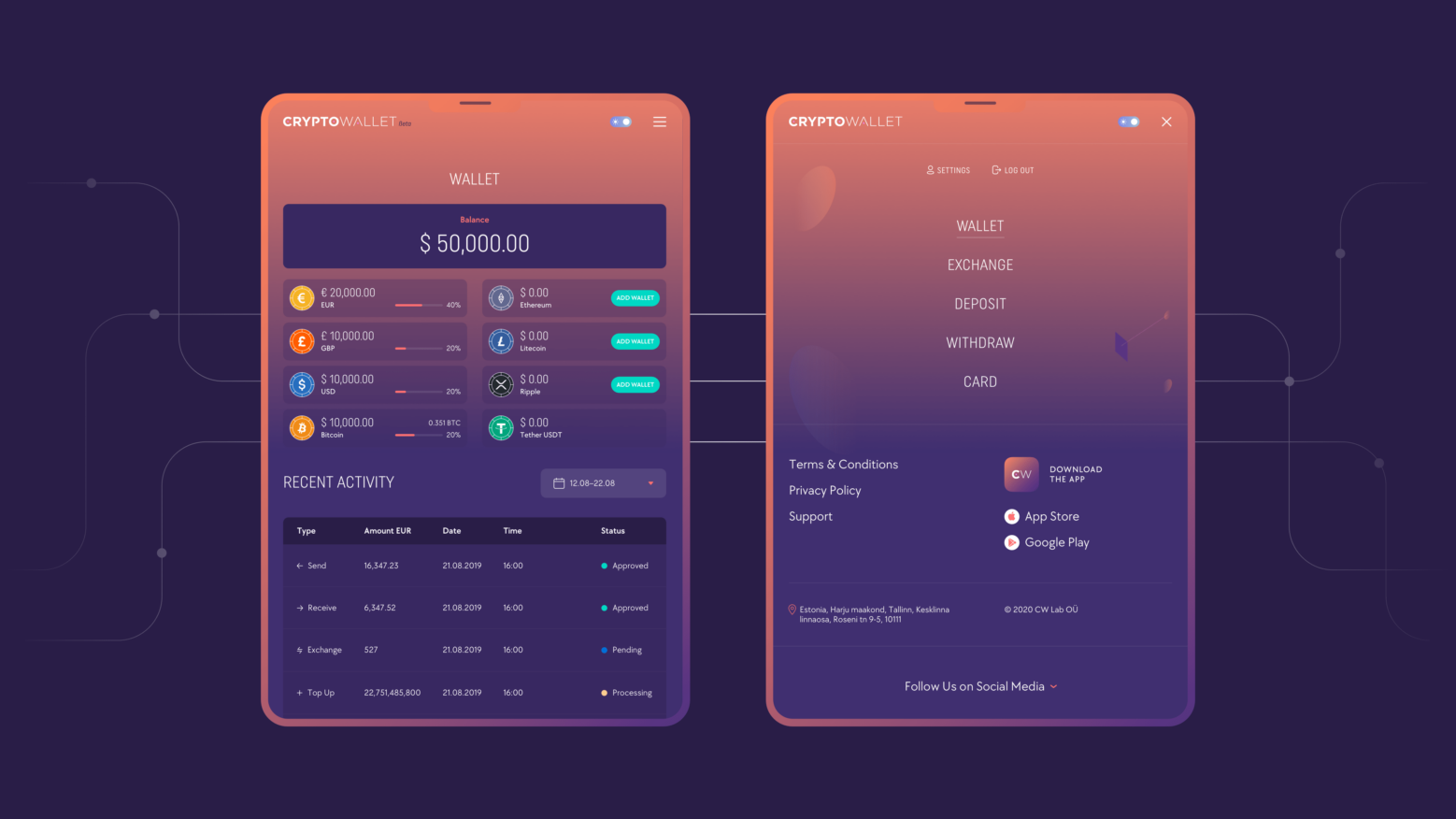

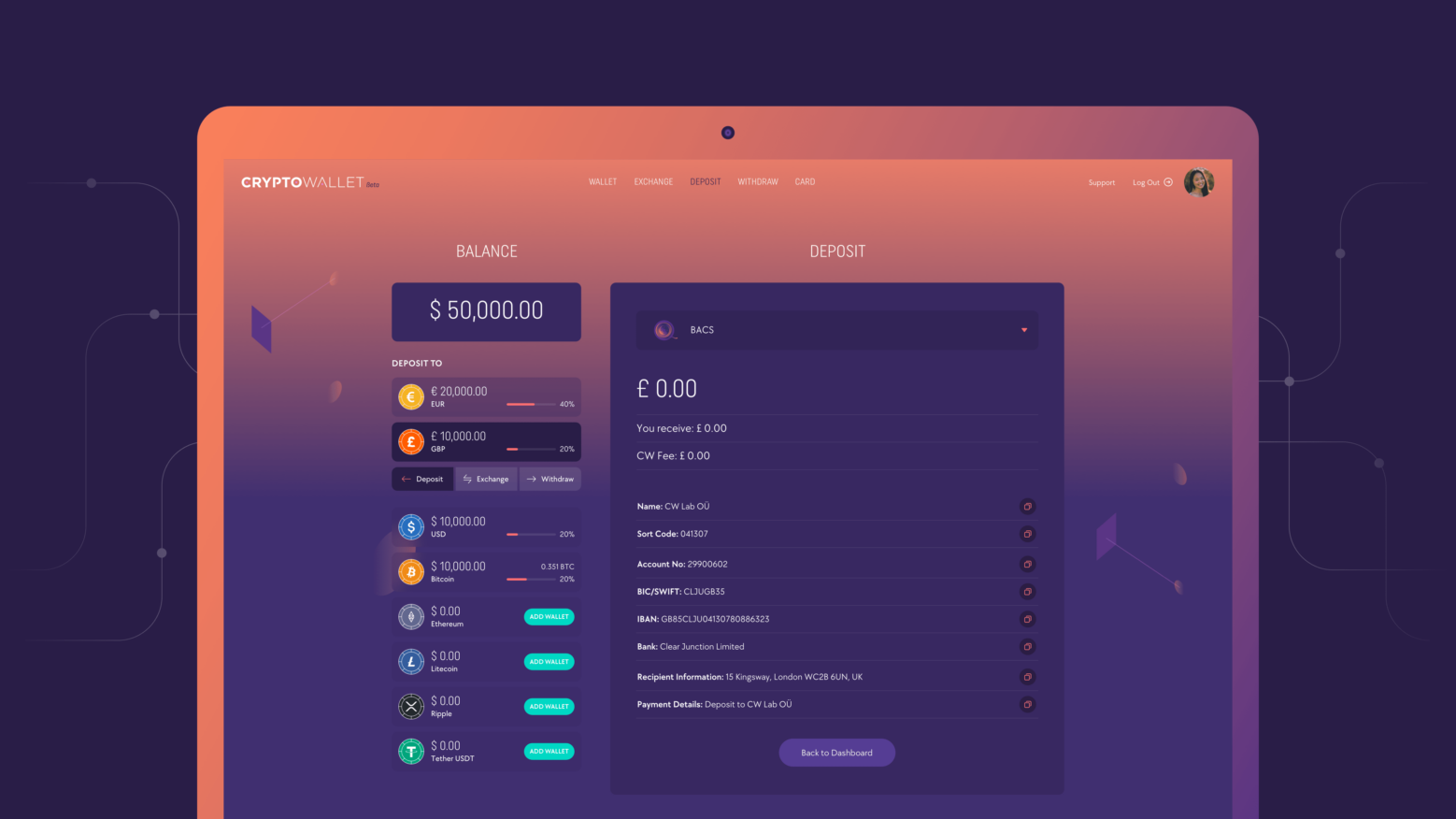

1 CryptoWallet.com #1 Recommended

CryptoWallet.com offers the ability to buy, sell and hold cryptos in a secure digital wallet with a unique feature that supports spending your crypto on the go, either as payment in online/offline purchases or simply withdrawing it as cash.

You can earn passive income in crypto, open an IBAN and pay bills in crypto, or go shopping with a crypto debit card.

Sign up for your crypto debit card here!

- Ease of use: Very easy

- Fees: Fees vary based on trading activity

- Rating: 5 star

- Verification: Phone and email KYC

Pros (What We Like)

- Supports crypto purchase in major fiat currencies

- Seamless and simple user-interface

- Great platform and mobile wallet app security

- Highly available and responsive customer support service.

Cons (What We Don’t Like)

- 5 cryptos in total, whereas some exchanges support a larger selection

- Mobile only

2 Bitstamp

Bitstamp is known primarily for its interactive trading platform, consisting of relevant trading options aiding users with crypto price prediction.

- Ease of use: Intermediate

- Fees: Makers – 0.1 % Takers – 0.2 %

- Rating: 5 star

- Verification: Multiple levels of verification ranging from phone and email to personal ID

Pros (What We Like)

- Trading on-the-go as it offers mobile android and IOS platform support

- High daily trading volumes and liquidity

- Low deposit and withdrawal fees

Cons (What We Don’t Like)

- Although security may have improved, it is still worth mentioning that the exchange has been hacked twice since its inception in 2011

- KYC verification process can be rigorous and considered invasive by some

- Customer support is not so great

3 Huobi

Digital currency platform catering mostly to the Asian market with establishments in 12 countries including the US and Japan.

- Ease of use: Intermediate

- Fees: Makers – 0.2 % Takers 0.2 %

- Rating: 5 star

- Verification: Four levels of KYC, beginning with phone and email

4 Bisq

Bisq (formerly Bitsquare) is an open-source, decentralized peer-to-peer exchange that enables cryptocurrency trading for national currencies without a third-party broker or financial intermediary.

- Ease of use: Intermediate

- Fees: Makers – 0.1% Takers – 0.7%

- Rating: 4 star

- Verification: A simple 2-step verification process ( Personal account verification and KYC)

Pros (What We Like)

- Decentralized exchange

- Highly secure and offers private trading activity

- Offers lower transaction fees and high transaction speeds

Cons (What We Don’t Like)

- Not so user friendly

- The wallet is not portable i.e you can not trade on the go as it is a desktop application

- Everything, including your private wallet, is managed and stored by you which could be quite tasking to some users

5 Poloniex

US-based cryptocurrency exchange with a wide range of crypto assets listed.

- Ease of use: Easy

- Fees: Makers – up to 0.1450%, Takers – up to 0.1550%

- Rating: 4 star

- Verification: Level 1 – Email and password authentication, Two-factor authentication. Level 2 – KYC verification

Pros (What We Like)

- High daily trading volumes

- Wide variety of asset trading pairs to choose from

- Offers market charts on its exchange page with basic market analysis options

Cons (What We Don’t Like)

- Customer support is not so great compared to other crypto exchanges

- The exchange was hacked back in 2014

6 Luno

Luno provides wallet and exchange services in over 40 countries across Europe, Asia, and Africa.

- Ease of use: Easy

- Fees: Makers – 0% Takers – up to 0.1%

- Rating: 5 star

- Verification: Three levels of KYC, starting with mobile number

Pros (What We Like)

- Provide educational step guides for beginners into Bitcoin & cryptocurrency trading

- Highly safe and secure platform

- A user-friendly interface, easy platform navigation

Cons (What We Don’t Like)

- Not suitable for advanced traders as trading options are limited

- Highly regulated and offers little or no privacy

7 Bitpanda

With its major market and popularity in Europe, BitPanda offers fiat payment options more than most other platforms.

- Ease of use: Intermediate

- Fees: Makers – up to 0.1%, Takers – up to 0.15%

- Rating: 5 star

- Verification: Level 1 – ID verification, passport accepted in Norway

Pros (What We Like)

- Web-based and mobile application with Android and IOS platform support

- Strikes a good balance between serving pro traders and beginners

- Offers a wide range of fiat payment options such as bank wire and users may also fund their accounts via bank transfers

Cons (What We Don’t Like)

- High trading fees

- Only offers email support

8 LocalBitcoins

LocalBitcoin serves as an escrow strictly offering peer-to-peer (P2P) bitcoin transactions.

- Ease of use: Intermediate

- Fees: Makers – 1%, Takers – 0 %

- Rating: 4 star

- Verification: Four levels, starting with email address

9 Paxful

Another escrow service provider offering peer-to-peer cryptocurrency transactions of Bitcoin(BTC), Ethereum (ETH), and USDT.

- Ease of use: Intermediate

- Fees: Makers – 1%, Takers – 0 %

- Rating: 4 star

- Verification: Four levels, beginning with phone and email registration

Pros (What We Like)

- Wide variety of payment options such as

- Highly secure wallet and escrow service provider

- 24/7 customer support

Cons (What We Don’t Like)

- Limited trading options

10 Bittrex

Bittrex is a major exchange offering over 200 cryptocurrencies on one platform.

- Ease of use: Advanced

- Fees: Makers – 0.20 %, Takers – 0.20 %

- Rating: 4 star

- Verification: Requires a govt-issued ID and a facial identification

Pros (What We Like)

- Offers a wide variety of altcoins and crypto-trading currency pair

- Advanced security options and cold-wallet services

- Trading platform for advanced users

Cons (What We Don’t Like)

- Not so friendly to beginners

- Low liquidity for some cryptocurrencies

- Margin trading is unavailable for majority of the coins

11 Paybis

A UK-based crypto exchange with operations in over 180+ countries, supporting 10 cryptocurrencies including Bitcoin (BTC), Bitcoin Cash (BCH), Ripple (XRP) and Tether (USDT).

- Ease of use: Intermediate

- Fees: Makers – 1.5 % Takers -1.5 %

- Rating: 3 star

- Verification: Government ID required

Pros (What We Like)

- Registration and on-boarding is fast and seamless

- Supports all major fiat currencies for crypto purchases

- Highly regulated and anti-money laundering (AML) compliant

Cons (What We Don’t Like)

- Very high trading fees, especially with debit/credit deposits

- Only limited coins are available for sale on the platform

FAQ

Is cryptocurrency legal in Norway?

Yes.

Although cryptocurrencies are highly unregulated and the Norwegian government continually issues warnings on the market risk of investing in cryptos, Bitcoin in particular, the growing interests of the government in the future of money in Norway is not hidden away.

Norway’s central bank has announced its plan to test the technical possibilities for a CDBC(central bank digital currency) over the next two years.

How do I turn my cryptocurrency into cash?

Converting your crypto assets to cash such as BTC to NOK can be done via a broker exchange or a peer-to-peer (P2P) platform.

The selling method to use depends on how fast you need access to cash and how much security risk you can afford.

Broker exchanges are not as fast as peer-to-peer transactions, however, they offer more security and assurance of not being swindled.

How much does crypto cost?

You can find the estimated cost of a crypto asset in your local currency (say BTC to NOK) with a quick google search or a trusted price-tracking platform.

However, factoring in the transaction cost, exchange fees, taxation rate and spread fees give a more rounded estimate into the actual cost of crypto in Norway.

Which countries have banned Cryptocurrency

Bolivia was the first country to flat-out issue a crypto ban, and other countries such as Algeria, Nepal, China, and Turkey have followed suit.

Individual countries have their variation of a crypto ban. Some countries – most notably the UK and the US – have banned specific exchanges, some have banned specific crypto assets (Bitcoin), and a few banning all crypto trading activity due to religious reasons, like in Egypt, so it is advisable to review your country’s stance on cryptocurrency.

Do I need a license to sell cryptocurrency?

Retail investors do not need a license to sell crypto. Licensing only applies to businesses offering exchanges services, as they need to remain compliant with anti-money laundering regulations (AML/KYC).

However, regular investors are free to choose an exchange sell their crypto for NOK or other currencies.