Where to Buy Bitcoin and Crypto in the Netherlands

The Netherlands is a growing crypto market, with an estimated 5% of the population already invested in Bitcoin.

As a forward-thinking nation with a healthy appetite for cryptocurrencies, there are a number of ways to buy Bitcoin and crypto in the Netherlands! Let’s look at the legal status of crypto, the best ways to choose an exchange, and a list of the best crypto exchanges in NL.

Bitcoin & Cryptocurrency Trading in the Netherlands

700,000 Dutch people have already made an investment in BTC, and 20 cryptocurrency service providers are registered with the Dutch Central Bank. Of course, many overseas providers also cater to the Dutch market.

Which Cryptocurrencies Can be Bought in the Netherlands?

Dutch people have access to any and all cryptocurrencies on the market, limited only to the selection on the particular exchange or app they’re using to buy crypto.

No particular cryptocurrency is illegal or inaccessible within the Netherlands, according to current crypto regulations, and that is not expected to change as the Netherlands does not have particularly strict regulations.

How to Choose a Crypto Exchange

The main factors when choosing an exchange are whether it’s easy to use/appropriate for your skill and knowledge level, whether it’s secure, how much it costs to use, and the selection of fiat and cryptocurrencies available.

How to buy Bitcoin in the Netherlands?

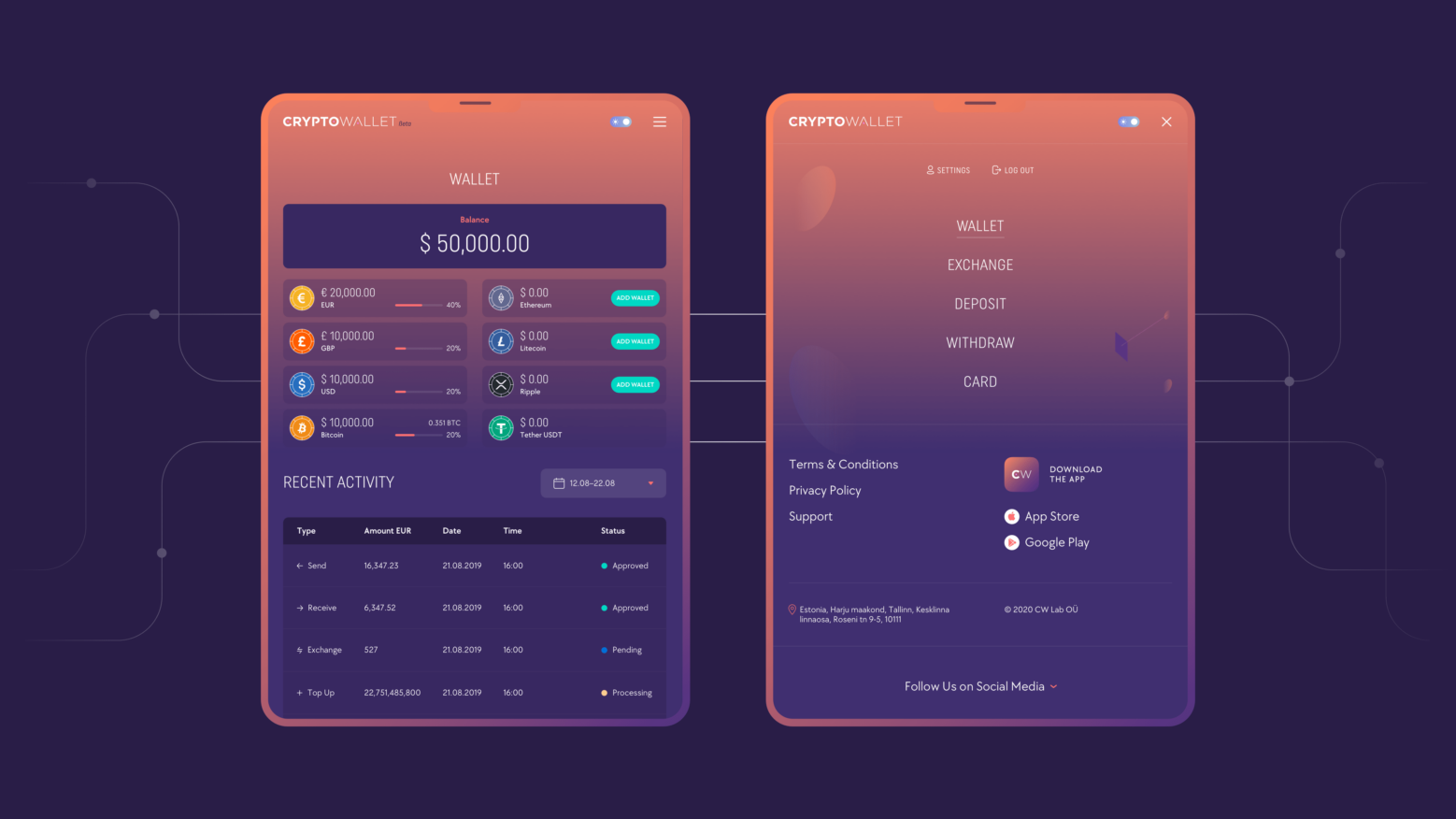

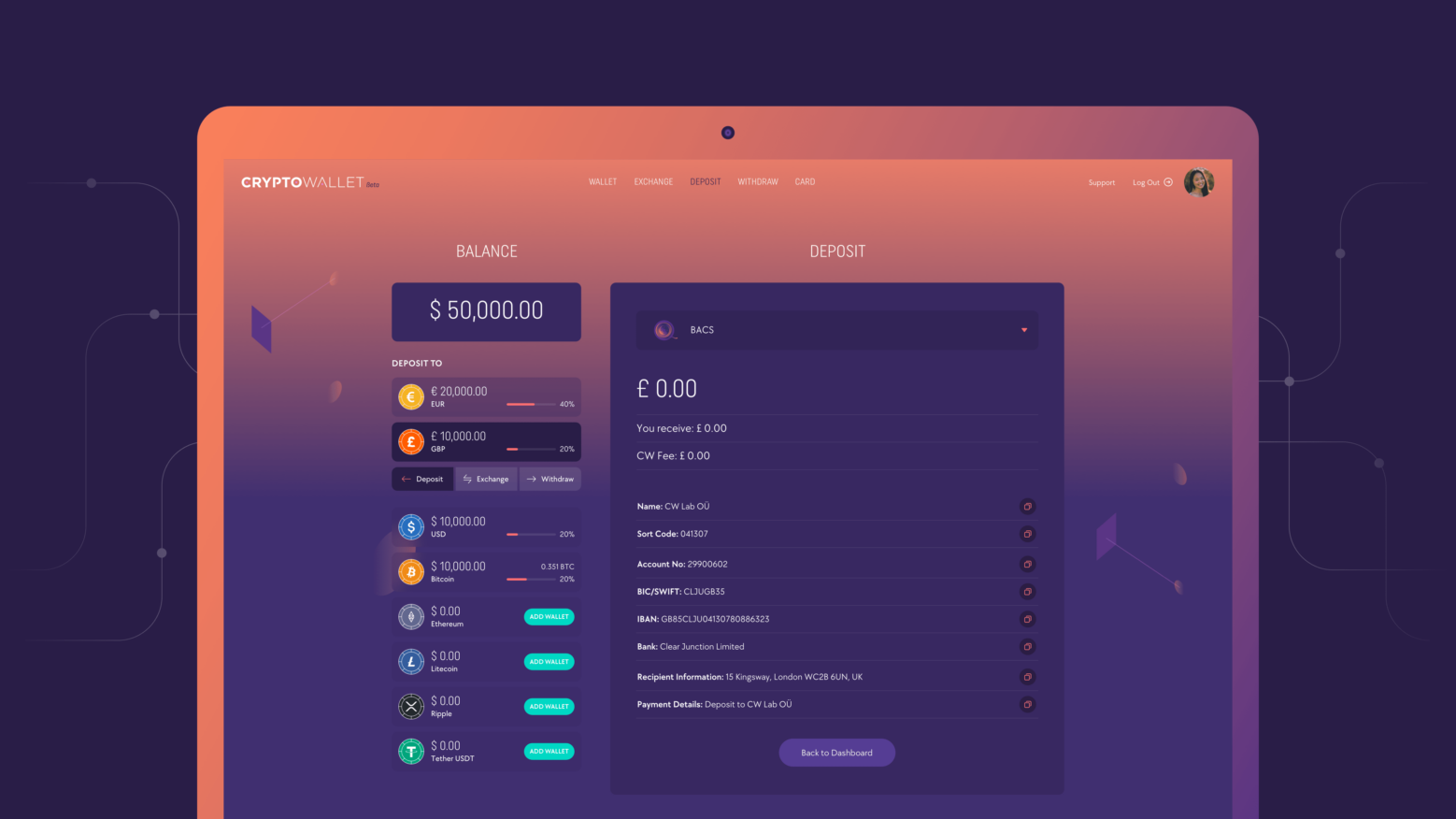

Before we look at our top picks for the best crypto exchanges in the Netherlands, here is a brief rundown on how to buy Bitcoin in the Netherlands. There is an abundance of different crypto trading platforms available, but for this example, we will use CryptoWallet.com.

First, register an account with CryptoWallet.com. You’ll then be guided through the process of setting up an account. To create your account you will need to provide personal data and identification. During the set up you’ll be given a key phrase. You must keep this key phrase safe as it’s the only way to regain access to your account if you lose the password.

Then, you’ll simply have to link your fiat account to your CryptoWallet.com account and deposit the funds you want to spend. Then go to the CryptoWallet.com trading page and find the trading pair of BTC and your fiat currency (for example BTC/euro). Once you have found the correct trading pair select the amount of BTC you wish to purchase and click confirm. Once you have clicked confirm the BTC will be transferred directly into your crypto wallet. That’s how to buy crypto in the Netherlands!

Here are the Best Exchanges to buy Crypto in the Netherlands

1 CryptoWallet.com #1 Recommended

Before we begin with our list of regular exchanges, we’d like to highlight our top option.

CryptoWallet.com is much more than a crypto exchange. Users can buy Bitcoin, Litecoin, Ripple, Ethereum, and Tether, yes — but they can also spend these currencies as real money. If you order a CryptoWallet.com debit card, you can actually go into a store and buy anything you like with your crypto, and if you sign up friends, you’ll earn a portion of their transaction fees whenever they use their card.

You can pay bills in crypto and store fiat in a personalized IBAN, and all funds are fully insured and secured.

Interested? Try out CryptoWallet.com here!

2 Bitpanda

Bitpanda is a crypto exchange based in Vienna, Austria with a selection of 20 different cryptocurrencies. The exchange, founded in 2014, uses a native token called BEST to reduce fees when users buy crypto with it. Otherwise, fees for BTC transactions start at 1.49%.

- Ease of Use: Intermediate

- Fiat Compatibility: EUR, USD, GBP, CHF and TRY

- Fees: 1.49% or lower

- Limits: ~$1,800 withdrawals for unverified users

3 Coinbase

Coinbase is a leading crypto exchange of the world’s largest exchanges for digital currency, with a user-friendly interface and 50 major cryptocurrencies on offer.

Users can deposit funds via wire transfer/private bank transfer among a variety of payment options, and credit card purchases are available. Coinbase also offers brokerage services and custody options for institutions. Transaction fees are relatively high.

- Ease of Use: Easy

- Fiat Compatibility: Dozens of currencies

- Fees: 1.5% – 4% for fiat purchases, up to 0.5% for crypto trades

- Limits: $25,000 daily for KYC verified users

4 eToro

eToro is one of the most popular cryptocurrency exchanges out there, with a wide range of cryptocurrencies available along with stocks and CFDs. Users can automate their trading to mimic that of other successful traders on the platform.

eToro users must deposit a minimum of $500 USD or equivalent currency before trading, and there is a thorough verification process to pass before making a Bitcoin purchase or trading between crypto & Bitcoin. The platform accepts 14 different fiat currencies, allowing you to convert cryptocurrency into euros.

- Ease of Use: Intermediate

- Fiat Compatibility: Dozens of supported currencies

- Fees: 0.75% on BTC trades

- Limits: $10,000 daily deposit

5 Paybis

Paybis is one of the biggest cryptocurrency marketplaces in the UK, and also caters to the Dutch market. It supports 10 cryptocurrencies including Bitcoin, Ethereum, Bitcoin Cash, and more.

Despite not having an extensive range of crypto assets on offer, the many fiat currencies and payment options such as bank deposit and credit card/debit card payment and wire transfer appeal to many traders.

- Ease of Use: Very easy

- Fiat Compatability: 47 fiat currencies

- Fees: 1.5% or higher for card transactions

- Limits: $20,000 USD per week, $50,000 per month. EUR bank transfers allow up to 200,000 EUR per week.

6 Coinmama

Coinmama supports a limited range of 8 crypto assets with options to transfer funds including wire transfer of common currency/fiat currency along with options like Apple Pay. Transaction fees are relatively high, starting at 3.9%, although users can reduce those fees by earning loyalty rewards through active trading.

- Ease of Use: Intermediate

- Fiat Compatibility: GBP, EUR, AUD, CAD, JPY, USD

- Fees: Up to 3.9% for buys, up top 4% for sells

- Limits: $15,000 USD daily

7 Kraken

Kraken is one of the most widely-used platforms for virtual cryptocurrency investing. While there is more of an intensive verification process than with some cryptocurrency marketplaces, the tradeoff is security and a solid reputation.

It’s suitable for beginners it offers trading pairs for over 40 current assets. A major flash crash in 2021 saw ETH and BTC price on the platform drop far lower than the fair market rate, resulting in lost funds and accidental cryptocurrency transactions and liquidations. This was due to a lack of supply of Bitcoin and Ethereum in the exchange’s personal wallet. However, all exchanges come with some small market risk or risk of loss due to market conditions, and overall the exchange has been highly popular and reliable over the years.

- Crypto Assets: Very easy

- Fiat Compatibility: EUR, GBP, JPY, CNY, USD

- Fees: 0% – 0.16% taker fee, 0.1% – 0.26% maker fee, higher for credit card fees

- Limits: $5,000 USD daily withdrawals for 30 days, then unlimited withdrawals (crypto)

8 Exmo

Exmo is a British crypto exchange with many fiat and crypto options. Users can transfer funds from their personal wallet if they already own crypto, or use a wire transfer and a huge range of payment methods (more than hundreds of platforms competing in the space).

The trading platform features a helpful news section to educate its users, along with a step-by-step guide for various aspects of the platform. Trading fees are relatively low for Bitcoin transactions and other actions on the platform.

- Cryptocurrencies: 57

- Fiat Currencies: USD, EUR, GBP, RUB, PLN, TRY, UAH, KZT

- Deposit Methods: Exmo supports a range of payment methods including debit cards, Skrill, BanContact, QiWi, Payeer, MoneyPolo, and many more.

- Fees: Trading fees start at 0.3% with reductions for higher sums.

9 Bitstamp

Bitstamp is a peer-to-peer exchange that supports five cryptocurrencies. Exchange transactions cost 0.25%, a relatively low sum, and KYC is only required for traders seeking to withdraw their funds as fiat currency.

- Ease of Use: Intermediate

- Fiat Compatibility: USD, EUR, GBP

- Fees: 0.25% for trades under $10 million

- Limits: 2500 USD/EUR/GBP daily

Netherlands Crypto Exchange FAQs

How to invest in cryptocurrency in the Netherlands?

As you can see, there are many different options when it comes to investing in crypto in the Netherlands. You’ll need to weigh up your options for the best crypto exchange in the Netherlands before investing. Factors include the number of cryptos available for trade, added features such as customer support or a crypto debit card, fiat compatibility, and more.

Once you’ve chosen a good exchange, simply register and deposit funds onto the exchange to continue. The easiest exchanges to use are compatible with fiat, meaning you can deposit money like EUR or GBP to the exchange. CryptoWallet.com allows users to send EUR and GBP to their wallets and then immediately trade these funds for crypto like Bitcoin. The exchange also offers a debit card to spend crypto in any store as well as 24/7 customer support.

If you’re wondering where to buy crypto in the Netherlands, download the app from the CryptoWallet.com site and order your debit card now! You can also sign up new users through our referral program and earn a portion of any fees charged to their debit card, allowing you to buy, trade, spend, and even earn crypto all in one place!

Is Bitcoin legal in the Netherlands?

With the wide-scale adoption of bitcoin and other cryptocurrencies, governments around the world are starting to take notice and have started to implement regulations. Here is a brief overview of crypto regulations in the Netherlands.

Bitcoin is legal in the Netherlands. There are currently no laws prohibiting residents from buying and trading cryptocurrencies. However, there are some things you should know. From November 21st, 2020, companies trading crypto and crypto wallet custodians must register with the Dutch Central Bank. It’s just a registration requirement, not a license to trade crypto. Once they are registered, these companies will then require proof of identification from all customers wishing to trade cryptocurrencies. Any suspicious transactions may be reported to the government.

This is a short term solution to the worldwide crypto boom. The Netherlands is setting up a more complex system, so the government can monitor funds going into crypto to counter money laundering. At the time of writing, the government of the Netherlands are debating how to move forward with the acceptance of cryptocurrency in society. So rules can change quickly. But there is an optimistic outlook for the acceptance of cryptocurrencies, as the government has launched several blockchain projects.

Where can I buy crypto with debit card?

You can buy crypto with a debit card and a variety of payment options on CryptoWallet.com!

What is the safest cryptocurrency?

It’s not for us to say whether one cryptocurrency is safer than another. It’s important to assess the market risk when making an investment decision, as the loss of principal when crypto trading is typically permanent.

Ensure you’re buying at a fair market rate and using a reputable crypto exchange to avoid substantial risk when trading.

Do you pay tax when trading Bitcoin?

In the Netherlands, crypto is subject to capital gains tax as it’s considered a form of property at the time of writing.

How to buy crypto in Amsterdam?

To buy crypto in Amsterdam, simply sign up to CryptoWallet.com and get started!

How to invest in cryptocurrency in the Netherlands?

Once you have created an account with a crypto exchange, you will be able to deposit fiat. Once you have deposited your fiat you will be able to directly buy a limited number of cryptocurrencies. If the cryptocurrency you wish to invest in has a fiat trading pair (for example ETH/euro) then you can simply buy it. But often cryptocurrencies don’t have fiat trading pairs. In this case, you will need to find an intermediary cryptocurrency that you can trade for the cryptocurrency you wish to buy. For example, if you wish to purchase some Cardano(ADA) you must first deposit fiat into your crypto wallet, you can then look at the available trading pairs for ADA. Once you have found a suitable trading pair, for example, BTC/ADA, you can trade your fiat for BTC and then trade your BTC for ADA.

Once you have purchased your desired currency you may want to consider staking it. The best crypto trading platforms in the Netherlands will often offer staking options. Staking is when you offer up your cryptocurrency to be used to validate transactions on the blockchain, you will then receive a percentage of the trading fee. Staking typically yields between 5-10% interest a year and if you are holding for the long term it could be worth consideration. But be careful as there are risks involved, and as always do your own research.