How to Sell Crypto in the UK

The UK has always been a global finance hub, and now it’s moving into crypto as well. Are you considering selling your Bitcoin or other digital assets?

Before you pull the trigger, do a little research on the different exchanges and consider these factors: reputation, fees, withdrawal and payment methods, security, ease of use, and supported currencies.

We’ve created a list of the best exchanges you can buy crypto from in the U.K, so you don’t lose your hard-earned money or find it difficult to sell Bitcoin and digital currencies.

How to choose the best way to sell cryptocurrency

Choosing the best exchange to sell cryptocurrency can be quite difficult. There are several crypto exchanges out there that have experienced some hacks in the past. You need to research a wide range of platforms and compare the pros and cons of each option.

Consider the following factors when choosing the best crypto exchange to sell your crypto.

- Price. Consider the exchange rate of the platform and how it compares to those offered by other platforms.

- Fees. Compare all the trading fees that apply and whether there’s a fee for withdrawing funds into your bank account or crypto wallet.

- Trading and withdrawal limits. Find out if there is any limit on the amount of crypto you can sell, or on how much GBP you can withdraw from your account.

- Exchange’s security standards. Check if there are any security checks in place to help protect your funds and your private data, for example, 2-factor authentication or a credibility system for buyers and sellers.

- Customer support. Find out if they have efficient customer support in place if something goes wrong while selling your coins. And confirm if they’re available 24/7.

- Reputation and reviews. Check out online reviews and check crypto forum reviews from other users to find out whether they’d recommend a particular exchange or not.

Check if you need to pay tax when you sell crypto assets

Crypto trading or investing is a regulated activity in the UK. Her Majesty’s Revenue and Customs (HMRC) has issued strict tax guidance on crypto assets. HMRC does not treat cryptocurrency as currency or money but as different tokens – exchange tokens, utility tokens, security tokens, stablecoins– and the tax treatment depends on the use case of each of them.

If you hold any cryptocurrency as an investment in England, you will be subject to capital gains tax rules. This means you’ll be taxed on the capital gain of the coin at the time the cryptocurrency is disposed of (e.g. sold, traded, used for a purchase, etc.). If you trade cryptocurrency as a business activity, your profits will be subject to income tax rules. But HMRC doesn’t define what business activity is.

You will be charged income tax on cryptocurrency received via mining, airdrop, and crypto received as salary from an employer.

If you are at a loss, you can claim capital losses and use them to make up for the capital gains in the same tax year or future tax years. The duration for claiming capital losses is within four years from the end of the tax year when you realised a capital loss.

How to sell a large amount of cryptocurrency

The best way to sell a large amount of crypto is to use an over-the-counter (OTC) crypto trading service. This platform links buyers and sellers of cryptocurrency directly by matching the desired conditions specified by clients. There are several benefits of OTC trading; the trade will not affect the current value of the coin, there are no withdrawal limits, and you get to experience some anonymity during a transaction.

Here is a step by step instructions on how to sell large crypto in the UK through an OTC trade.

- Find a partner for the trade. You can check a chat room or an OTC brokering platform. When selecting an OTC broker, assess the lowest and highest rade amount accessible, the transaction fees, sign up process, supported cryptocurrencies, etc.

- The next step is to negotiate the terms of the trade with the broker. Indicate the amount of crypto you want to sell when you want the trade to take place and your desired price.

- Once a price has been agreed upon between the both of you, the buyer will send the agreed amount of GBP to you and you will send an equivalent amount of crypto to the buyer in return. Depending on the location you’re trading from, you and your trading partner might need to do KYC or due diligence on each other to meet legal regulations before trading.

The Best Exchanges to Sell Crypto in the UK

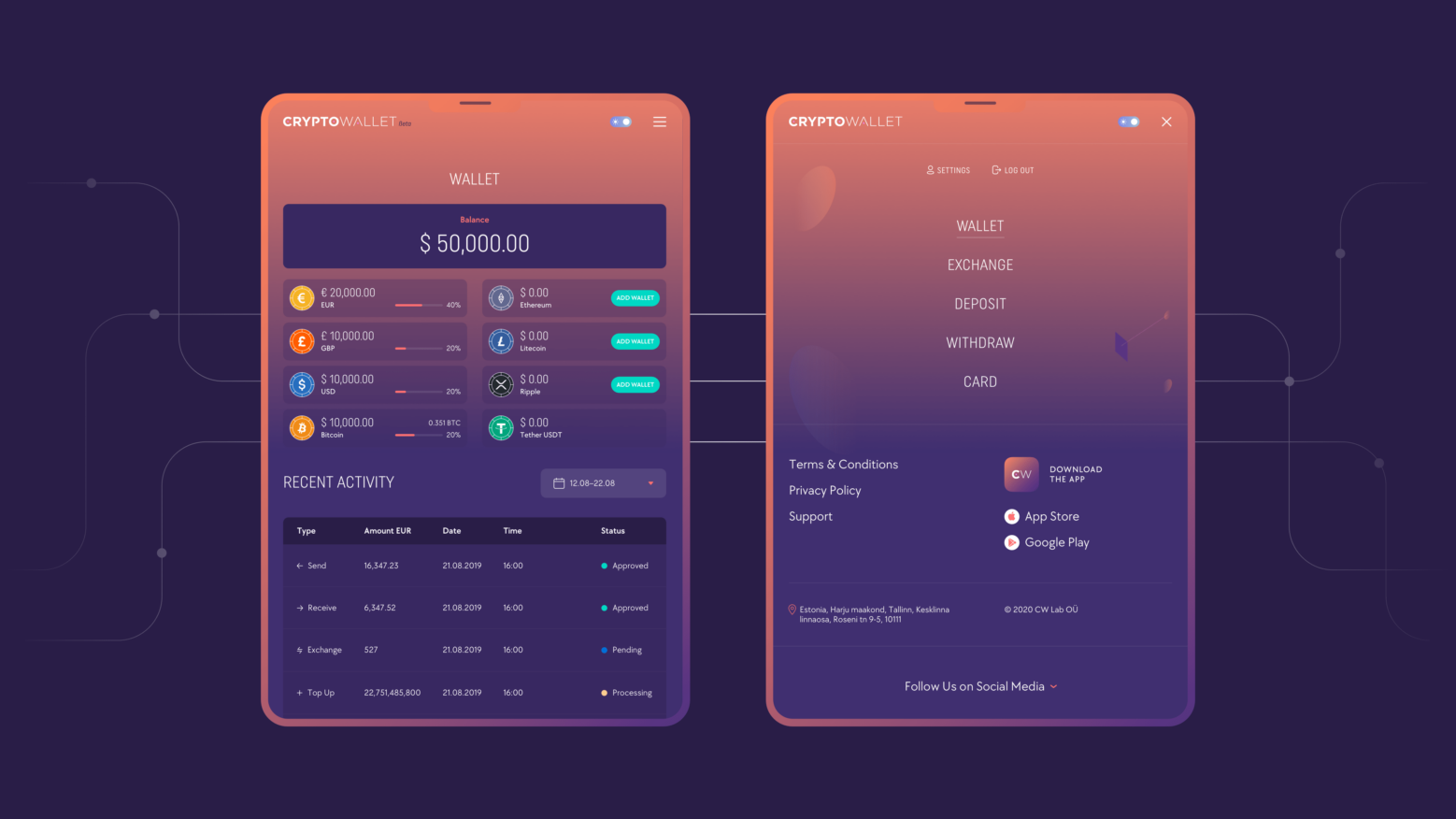

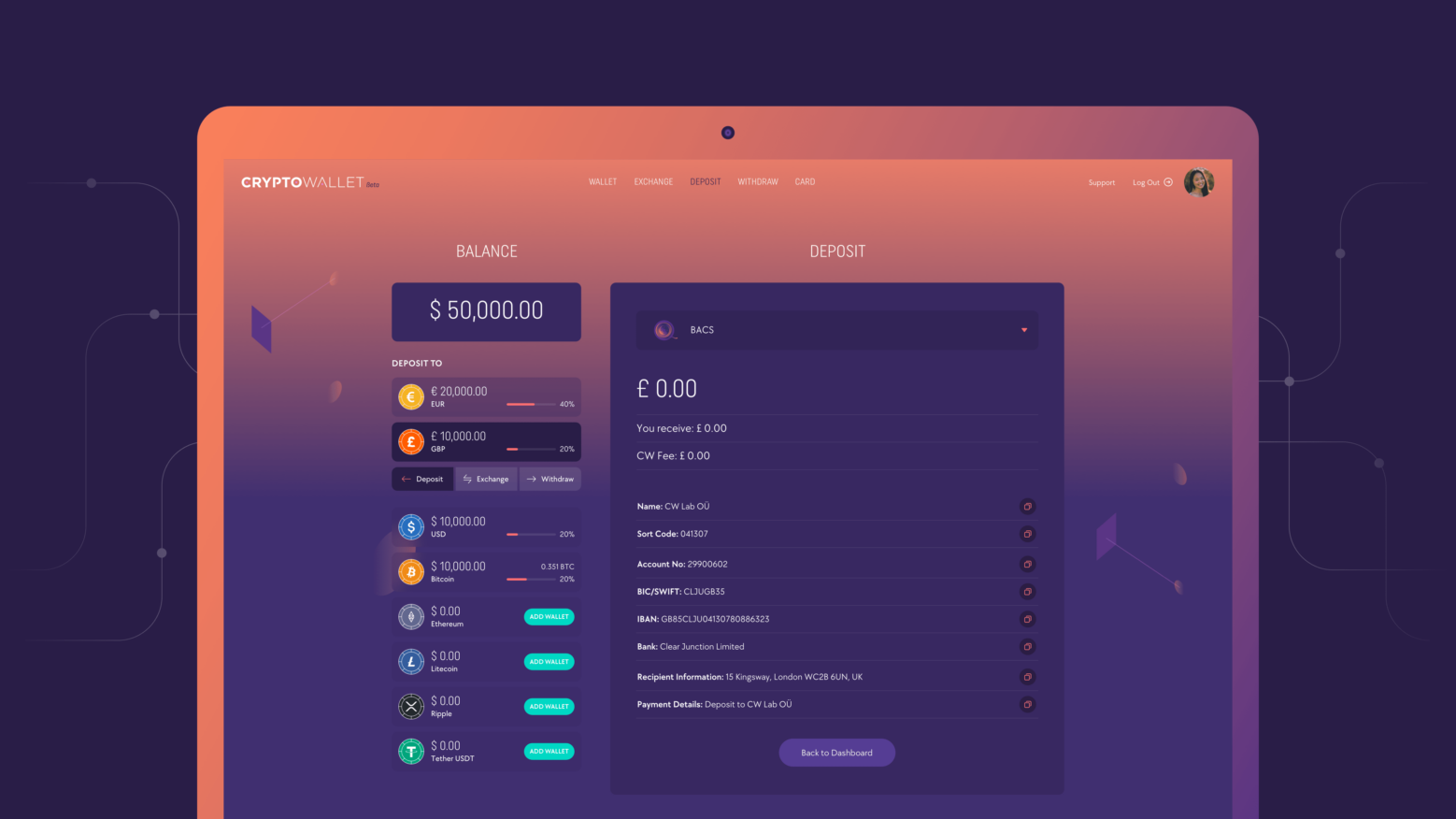

1 CryptoWallet.com #1 Recommended

CryptoWallet.com is an all-in-one crypto banking solution. Users can safely trade hundreds of high-cap cryptocurrencies, earn passive income, and even spend crypto in stores using the crypto debit card.

- Available Cryptocurrencies: Bitcoin, Litecoin, Ethereum, Ripple, USDT

- Fees: Fees vary depending on trading

Pros (What We Like)

- Lets you spend crypto in stores as real money

- Allows users to earn passive income

Cons (What We Don’t Like)

- Some users prefer to store their funds offline in “cold” wallets rather than mobile wallets. Of course, losing your phone doesn’t mean losing your funds — and you can always opt for both storage options!

2 eToro

eToro is a centralised exchange that offers a lot of digital assets to buy and sell on its platform. They also have a demo trading account to allow users to practice trading without using real money. Its platform lets users copy the trades of leading cryptocurrency investors.

- Available Cryptocurrencies: Currently has 14 cryptocurrencies for trading.

- Fees: Trading fees vary. Overnight and weekend fees apply.

Pros (What We Like)

- It allows both cryptocurrency and forex trading

- Demo account for beginners

- Copy trade feature

Cons (What We Don’t Like)

- High trading fees

- Doesn’t accept debit/credit cards.

3 CoinJar

Coinjar is a cryptocurrency broker and a crypto exchange that is best for beginners who have little experience with cryptocurrency trading. They have a 3.4* Trustpilot rating with over 1500 reviews.

- Available Cryptocurrencies: 24

- Fees: Free deposit and withdrawal fee in the UK

Pros (What We Like)

It offers ready-made cryptocurrency portfolios, it supports bank cards purchases. and it’s easy to use.

Cons (What We Don’t Like)

It doesn’t have technical indicators for trading.

4 BC Bitcoin

BC Bitcoin has the highest number of GBP trading pairs on our list and allows you to sell directly to your bank account. It offers a wide range of coins including Bitcoin, Bitcoin Cash, Ripple, Ethereum and Litecoin.

- Available Cryptocurrencies: 120

- Fees: 2% – 4%

Pros (What We Like)

Solid customer support, offers a large number of cryptocurrencies.

Cons (What We Don’t Like)

Limited payment methods, has a high minimum deposit fee of £500.

5 Paybis

Paybis is a secure exchange that supports a wide range of cryptocurrencies, and its fee structure is clear. It supports over 9 cryptocurrencies such as XRP, BTC, ETH, XLM, BNB, and more.

- Available Cryptocurrencies: 9 in total including Bitcoin

- Fees: Deposit fees vary but withdrawal fees are free.

Pros (What We Like)

It’s easy to use and offers great customer support for its multilingual users.

Cons (What We Don’t Like)

High fees when you pay with a card, limited advanced trading features.

6 Kraken

Kraken is a stable and credible cryptocurrency trading platform that offers a wide range of cryptocurrencies to traders. It provides simple payment methods for its users and offers competitive fees.

- Available Cryptocurrencies: Over 72 cryptocurrencies are available.

- Fees: Low maker fees starting at 0.16%

Pros (What We Like)

Highly secured, a wide range of cryptocurrencies, and cheap fees.

Cons (What We Don’t Like)

Not for beginners, limited starter account, a slow funding process.

7 Revolut

Revolut makes it fast, simple, and easy to buy and sell cryptocurrency from their app. It offers a variety of features for users to choose from.

- Available Cryptocurrencies: It supports Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and over 30 other cryptocurrencies.

- Fees: 2.5%

Pros (What We Like)

It’s accepted worldwide, supports both fiat and cryptocurrencies, it’s licensed and secure.

Cons (What We Don’t Like)

No options to withdraw cryptocurrency or send crypto to Revolut from an external wallet — users are essentially buying into the price action of crypto without being able to use it outside of Revolut. Many features come at an extra cost.

8 Exmo

Exmo offers a wide range of accepted fiat currencies to fund your account with. Each digital coin in the exchange can be traded against a wide range of fiat currencies such as USD, EUR, GBP, RUB, and UAH to accommodate customers from the USA, UK and other regions in Europe.

- Available Cryptocurrencies: Over 50 cryptocurrencies are available for trading.

- Fees: It offers a flat trading fee of 0.30%. 0.30% which is above average fees.

Pros (What We Like)

It has low user fees and offers several cryptocurrency trading pair to trade with.

Cons (What We Don’t Like)

Frequent exchange downtime, inconsistent deposit and withdrawal conditions.

9 CEX.io

Cex.io crypto exchange is great for both advanced users and beginners getting started with buying and selling cryptocurrencies. It accepts many deposit types and supports different digital assets.

- Available Cryptocurrencies: It supports over 60 digital assets.

- Fees: As low as 0.25% and 0.16% for maker and taker respectively.

Pros (What We Like)

Easy to use, has instant card deposits and great customer support.

Cons (What We Don’t Like)

It has a rigorous security verification process after sign up, and limited cryptocurrencies.

10 Indacoin

Indacoin is a British and cryptocurrency exchange that was established in 2013. It lets you buy bitcoin and other digital currencies with a credit or debit card without verifying your identity.

- Available Cryptocurrencies: It supports over 158 cryptos.

- Fees: Trading fees vary.

Pros (What We Like)

Buy cryptos with a credit card — no account needed, no deposit fees.

Cons (What We Don’t Like)

Selling and withdrawing is quite difficult, high withdrawal fees.

FAQ

How do I minimize my tax burden?

Every taxable individual in the UK has a personal CGT( Capital Gain Tax) allowance of up to £12,000 every year (6 April to 5 April), which is enough for most crypto investors to avoid paying tax. If you’re still in need of ways to minimise your tax burden, follow these simple on how to do so

- First of all, always ensure you make use of the CGT allowance for every year.

- Sell some of your assets at a loss if the total gain in the tax year exceeds the tax allowance and offset the loss against the gains in the tax year to reduce the number of taxable gains.

- If you have a civil partner, transfer your assets between you and your spouse to benefit from the CGT allowance of you and your partner.

- Contribute some of your assets to a pension where you have some good earnings. The CGT you’ll pay when disposing of the assets will be reduced from 20% to 10%.

What if I don’t file my crypto taxes?

HMRC has up to 20 years following the end of the relevant tax year to enquire into your tax returns. If you intentionally fail to file your crypto taxes or it has been underpaid, you may be liable to interest and penalties of up to 100% of the amount of tax due. In the most severe situations, you may serve some jail term.