How to Buy Crypto in Finland

Finland is a growing crypto market with interest in Bitcoin, Ethereum, and other cryptocurrencies steadily rising. The Finnish government hasn’t rolled out any crypto-specific legislation, opting to treat cryptocurrency as subject to capital gains tax, and the relatively welcoming climate has led to exchanges popping up within Finland itself.

Let’s dive into how and where people in Finland are buying crypto.

How to Buy Bitcoin in Finland

Crypto and Bitcoin are growing in popularity in Finland. If you’re looking to buy Bitcoin legally in Finland, you’ve a few options. You can use a cryptocurrency exchange or a Bitcoin ATM.

While there are a few Bitcoin ATMs available in Finland, it’s much easier to buy and sell Bitcoin using a cryptocurrency exchange. A cryptocurrency exchange is an online platform for buying and selling crypto tokens. Finland has both local and international cryptocurrency exchanges that let you buy BTC tokens.

Some exchanges support fiat currencies. These will let you purchase Bitcoin using Euros or other fiat money. Buying tokens can be done using a debit/credit card or wire transfers. Others are crypto-only, on these exchanges you’ll need to hold another cryptocurrency to trade with.

To use these exchanges or ATMs, you’ll need a crypto wallet to hold your BTC tokens. A crypto wallet lets you access and use your funds. Some exchanges offer a wallet which will simplify the process of buying Bitcoin. With others, you’ll need to connect your wallet to the exchange to buy BTC.

There’s a wide range of crypto wallets available with varying levels of security and ease-of-use, so it’s important to choose a wallet that suits your needs.

Exchanges to Buy Crypto and Bitcoin in Finland

There are many local and international exchanges to buy crypto in Finland. Each exchange offers unique features and services. What makes the best exchange will vary for each individual!

Some users want an easy-to-use, streamlined exchange that simplifies the process of buying crypto tokens. It’s also important to look at the fees and security of every exchange when making your choice.

Some crypto exchanges will accept fiat money like Euros which makes them a great entry point into the crypto market. Others are crypto-only, so you’ll need to hold cryptocurrency tokens already to trade on the platform.

Experienced traders may be more interested in advanced features like liquidity, yield farming or futures trading. These users may look for a more comprehensive exchange that can be difficult to navigate for a beginner.

We’ve selected and reviewed some of the most reputable cryptocurrency exchanges in Finland to help you choose where to purchase your Bitcoin and crypto. We’ve ranked them based on ease-of-use, fees, trading limits and fiat compatibility.

We invite you to take a look at the exchanges we’ve selected to find the perfect exchange for you!

Buying Crypto from a Finnish Exchange: Pros and Cons

There are no real benefits to buying crypto from an exchange based in Finland over other countries. The best way to measure an exchange is based on its reputation as well as the ease of use, fiat compatibility, and other factors listed below for each financial service selling currency tokens.

How to Choose a Bitcoin Exchange

We’ve selected crypto exchanges that we know have a solid reputation and further evaluated them in terms of their ease of use, compatibility with fiat currencies like the Euro, their fees, and their limits.

Let’s take a look.

Here are the Best Cryptocurrency Exchanges to Buy Bitcoin in Finland

1 CryptoWallet.com #1 Recommended

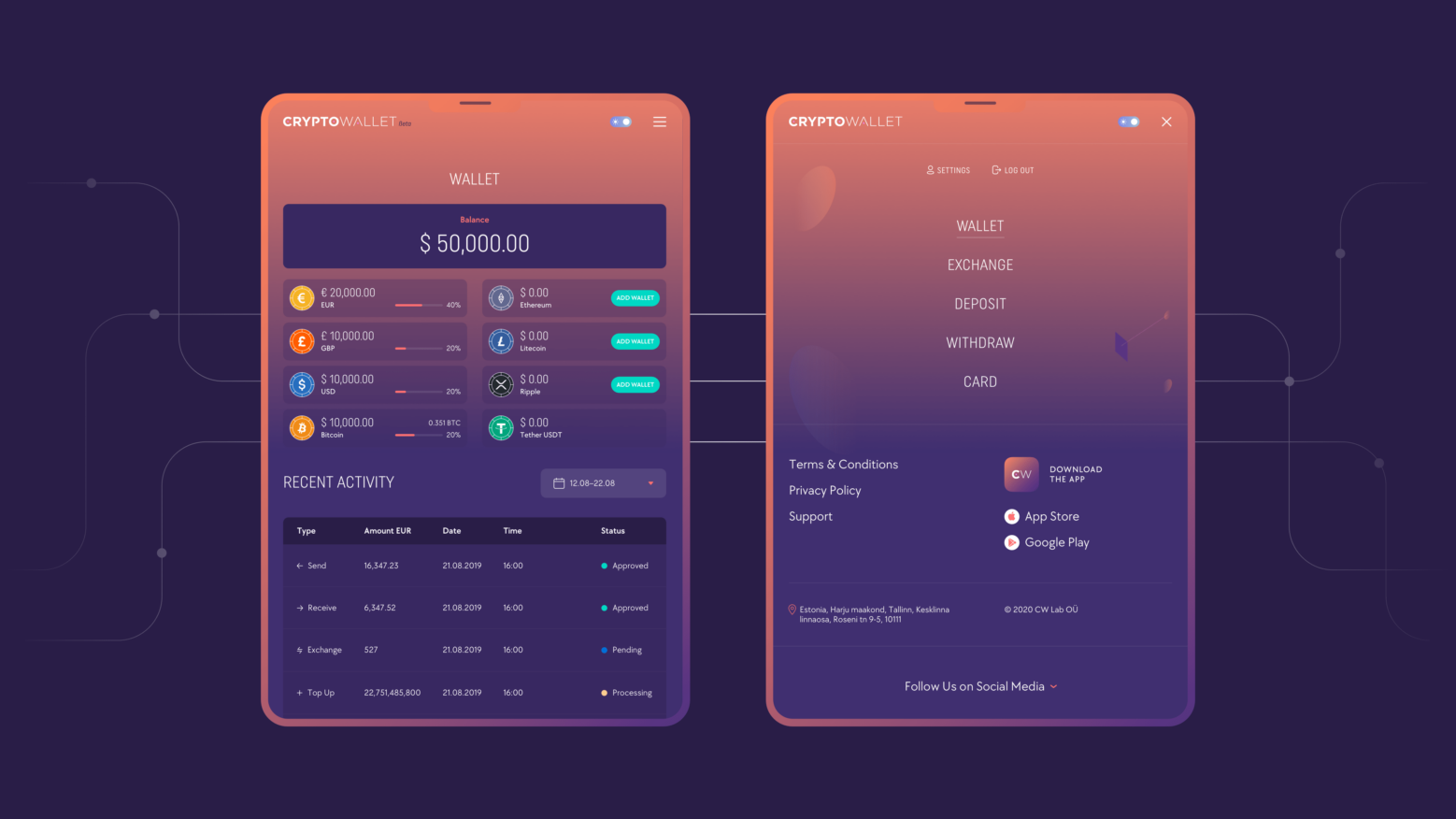

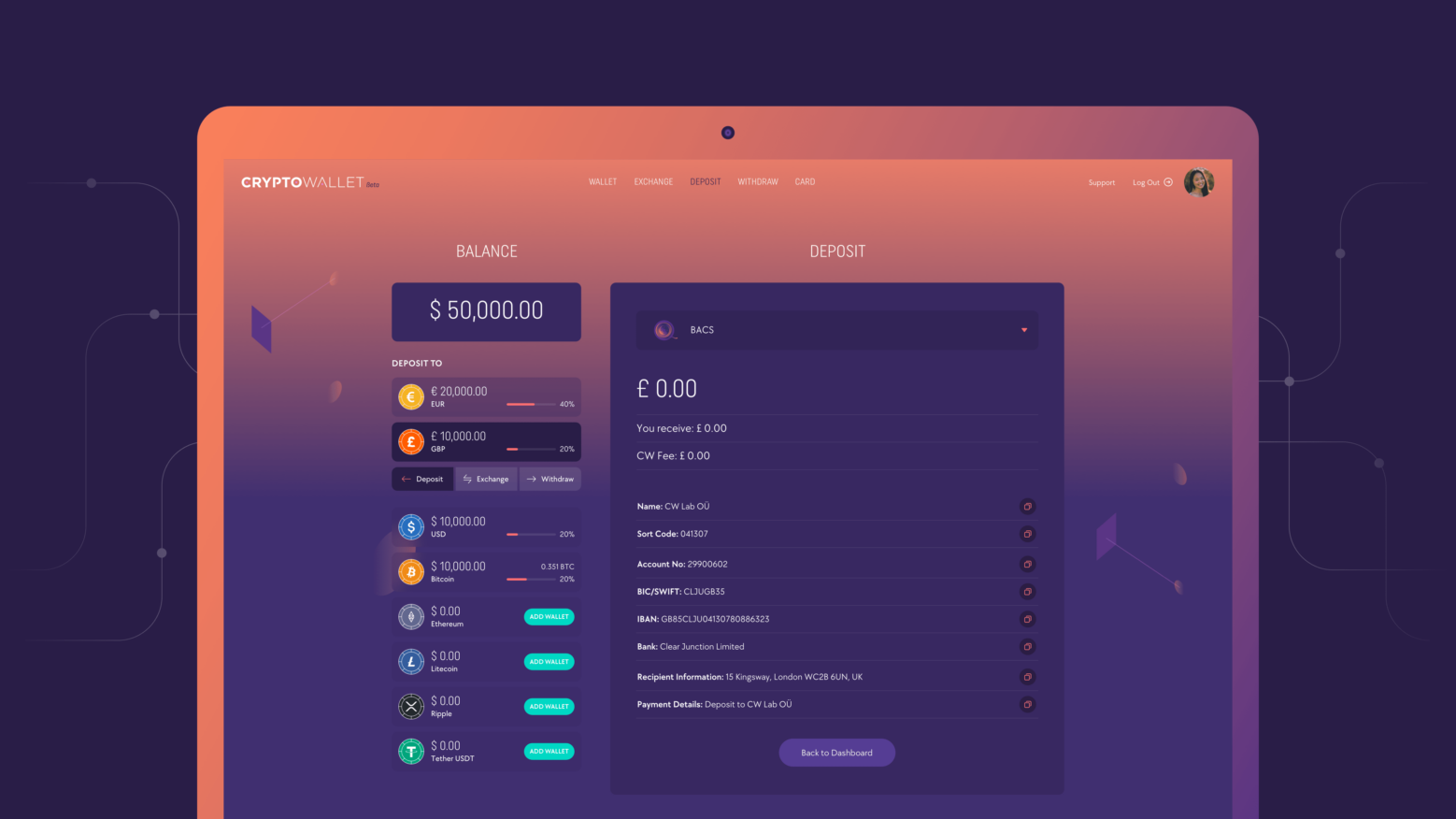

Before we begin with our list of pure exchanges, we’d like to mention Crypto Wallet.

Crypto Wallet is much more than an exchange. Users can buy and sell BTC, LTC, ETH, XRP, and USDT — but they can also spend these cryptocurrencies as real money using a crypto debit card. As a CW user, you can pay your bills in crypto, or go shopping with your Bitcoin profits.

You can earn ongoing referral fees from anyone you sign up to the service, and all funds are insured.

Sound interesting?

[Download Crypto Wallet now!]

2 Coinbase

Coinbase is a major cryptocurrency exchange and virtual currency provider that supports a number of payment methods and traditional currencies. Founded in 2012, Coinbase has become one of the most popular exchanges thanks to its longevity and intuitive user interface. A downside to using Coinbase is the higher than average user fees for exchange transactions.

- Ease of Use: Very easy

- Fiat Compatability: Dozens of supported currencies

- Fees: 1.5% – 4% for fiat purchases, up to 0.5% for crypto trades

- Limits: $25,000 daily for KYC verified users

3 Binance

Binance is the largest exchange in the world by trading volume and offers competitive fees as well. The trading platform has two versions, one for beginners and one for more advanced traders, and features such as stop-loss and margin trading are available. Due to the high volume of users, Binance reportedly has issues responding to customer support tickets.

- Ease of Use: Intermediate

- Fiat Compatability: 15

- Fees: 0.02% to 0.10% purchase and trading fees, 3% to 4.5% for debit card purchases

- Limits: 2 BTC per day for level 1 KYC, 100 BTC per day for level 2

4 eToro

eToro is a cryptocurrency exchange that supports stocks and CFDs as well as crypto and traditional currencies. A range of payment options are available, such as bank wire and credit card, and the platform has a minimum deposit of $500 USD. Fees on exchange transactions are in the mid range.

- Ease of Use: Intermediate

- Fiat Compatibility: Dozens of supported currencies

- Fees: 0.75% on BTC trades

- Limits: $10,000 daily deposit

5 CEX.io

CEX is licensed by the FinCEN regulator, making it one of the few fully regulated platforms for trading cryptocurrencies. Many trading features and a variety of payment options are available.

- Ease of Use: Easy

- Fiat Compatibility: USD, EUR, GBP, and RUB

- Fees: 0.25% taker fee, 0.16% maker fee, 2.99% for credit cards

- Limits: $3,000 USD daily deposit, $10,000 withdrawals for tier 1

6 Coinmama

Coinmama supports 8 crypto assets via a variety of payment options including credit and debit cards, bank transfer, or even Apple Pay. Trading fees on the sale of assets are high by industry standards, starting at 3.9%. A loyalty program can reduce fees and the actual acquisition cost of crypto somewhat, and this depends on each user’s personal activity on the platform and their use of the exchange accounts.

- Ease of Use: Easy

- Fiat Compatibility: GBP, EUR, AUD, CAD, JPY, USD

- Fees: Up to 3.9% for buys, up top 4% for sells

- Limits: $15,000 USD daily

7 Kraken

Kraken is a popular crypto exchange with multi-million volumes seen on a daily basis and many assets available. The provision of services includes trading pairs for over 40 current assets. Users can view their fiat currency in euros, US dollars, Japanese Yen, Canadian dollars, and British pounds. The user interface makes it easy to find the trading pair or currency in question.

Like stock exchanges, Kraken and other major exchanges are subject to some exchange rate fluctuations, and the exchange service drew criticism in 2021 when a flash crash decoupled ETH on Kraken from the fair market price of ETH, resulting in user losses. Despite this, the exchange remains popular and reputable, with market research on each asset category of crypto (financial coins, infrastructure coins, etc.) and other helpful learning materials.

- Crypto Assets: Easy

- Fiat Compatibility: EUR, GBP, JPY, CNY, USD

- Fees: 0% – 0.16% taker fee, 0.1% – 0.26% maker fee

- Limits: $5,000 USD daily withdrawals for 30 days, then unlimited withdrawals (crypto)

8 Bitpanda

Bitpanda is a cryptocurrency exchange that facilitates the conversion of Bitcoins and the trade of Bitcoin, Ethereum, and a wide range of other digital assets. Fees for Bitcoin trading are 1.49%, but range lower when users trade with the native BEST crypto token, an internal currency for the exchange, making the true buying price or actual cost of each purchase appealing to some investors.

As a rule of thumb, sending crypto can come with fewer fees than with online banking when users shop around, but for many, fees are less important than instant access to the thriving crypto markets.

- Ease of Use: Easy

- Fiat Compatibility: EUR, USD, GBP, CHF and TRY

- Fees: 1.49% or lower

- Limits: ~$1,800 withdrawals for unverified users

9 OKCoin

OKCoin is a highly liquid exchange with advanced trading features and a variety of virtual wallets. The exchange outperforms many competitors in the cryptocurrency industry terms of the selection of digital assets on hand. Fiat currencies are not supported, so trading with a basis in euros or other fiat is not possible. Fees are below average, with a maker fee of 0.10% and a taker fee of 0.20%.

- Ease of Use: Advanced

- Fiat Compatibility: USD, EUR

- Fees: 0.10% – 0.20% for trades under $100,000 USD

- Limits: $1 million daily

10 Bitstamp

Bitstamp is a peer to peer exchange that supports five currency tokens, a smaller range than cryptocurrency exchange services like Coinbase. There are few or no additional services beyond the selling of assets in the traditional sense. Exchange transactions cost 0.25%, and KYC is only required for traders seeking to withdraw their funds as fiat currency.

- Ease of Use: Intermediate

- Fiat Compatibility: USD, EUR, GBP

- Fees: 0.25% for trades under $10 million

- Limits: 2500 USD/EUR/GBP daily

11 Gemini

Gemini is a U.S. exchange with 20 supported cryptocurrencies including Bitcoin. Currency exchange fees are higher than many competing peer-to-peer exchanges. However, there is a market for Gemini due to its advanced trading tools and features.

- Crypto Assets: 20

- Trading Fee: 0.5% per trade and 3.49% for fiat purchases or 1.49% for bank account purchases

- Deposit methods: Wire transfer or credit/debit card

- Rating: 3/5

12 Paxful

Users on the Paxful exchange can trade Bitcoin, Ethereum, and the USDT stablecoin. Despite the limited range of currency tokens, over 300 payment methods are available such as bank wire, credit card, and PayPal. The price per share, or selling price, of each cryptocurrency is determined by the users themselves.

Prices on Paxful do not necessarily reflect current market prices, and the deemed acquisition cost of a cryptocurrency like Bitcoin could be higher or lower than current market prices, offering arbitrage opportunities. The purchase price does not always reflect the “actual cost” you may see on the wider market. As with any profits on cryptocurrencies in Finland, capital income must be reported when making a profit. It’s a good idea to factor in tax calculation when making trades of that nature.

- Ease of Use: Advanced

- Fiat Compatibility: USD

- Fees: 0% buyer, 1% seller

- Limits: $1,000 – $50,000+ depending on KYC

Finland Crypto Exchange FAQs

Does Coinbase work in Finland?

Yes, Coinbase works in Finland. The provision of cryptocurrency is legal according to Finnish legislation, meaning most crypto exchanges are available in Finland. Coinbase and most of the exchanges on the list here allow users to buy Bitcoins with cash directly. Coinbase recently filed as a publicly-traded company and traders worldwide can now buy company shares in the exchange, raising its international profile.

What is the price of Bitcoin in Finland?

Bitcoin is priced at the current market price in Finland and every other country. Some exchanges may have slight deviations from current market price, but this is irrelevant to geographical locations. Whether you’re buying bitcoins with cash (bank notes) in person, earning Bitcoin income from mining, or buying and selling Bitcoin on an exchange, the actual nature of your trading medium is irrelevant. Some platforms have slightly different prices, but the internationally agreed price of Bitcoin on the cryptocurrency market is constant.

Is Crypto Legal in Finland?

Yes. Finland’s Financial Supervisory Authority (FSA) has neither outlawed cryptocurrency nor written many laws specific to crypto. Income made with crypto is taxable income, and income from capital gain through selling crypto for a profit is subject to taxation according to the Financial Supervisory Authority.

Virtual currency mining is also legal, and any income earned from currency mining activity is taxable income. Digital currencies can be sold by P2P exchanges, and crypto as a source of income or personal income source should be treated as any other personal income source. Business assets are subject to tax per regular business income, whether those business assets are crypto or other financial assets. You can contact the Financial Supervisory Authority or a tax attorney for more clarity on specific trades or situations and their potential tax liability such as capital-gains calculation or general tax calculation rules.

Legally, crypto is not a form of money in Finland, and while the original acquisition cost doesn’t factor in the cost in taxation from taxable gain or direct gain, it’s important to remember that capital losses can be written off while trading, saving investors some money there.

Are There Any Crypto Exchanges Based in Finland?

Yes, there are a number of crypto exchanges based in Finland. We elected to recommend exchanges on merit rather than location, and our list features various international P2P exchanges. Many of the chosen exchanges keep most of their funds offline in cold wallets, adding a layer of security to the trading. Funds needed for immedate trading and business activity are stored in hot wallets, or online wallets.

What is a blockchain?

A blockchain is a computer network that stores data across many computers or “nodes,” and these all need to communicate and agree with each other in order to update or change network information. Forcibly controlling a blockchain network with hundreds of computers is, as such, hundreds of times more difficult than breaching just one computer, making these networks very secure. The contractual nature of the technology allows for more transparency when making agreements, as these agreements cannot easily be altered online.

The consumption of electricity of these networks is usually very high as a result of the many nodes, and electricity consumption is one of the criticisms often leveled at blockchain, with energy consumption monitored on a monthly basis.

However, many miners use cheap electricity provided by renewable sources like hydroelectric dams, and this cheap electricity and renewable energy sourcing coupled with improvements to blockchain’s electricity consumption profile through software updates are both providing solutions to the problem.