Where to Buy Crypto in Germany

Germany, one of the strongholds of the European Union, has been at the forefront in encouraging crypto adoption. German regulators were among the first to establish new policies to allow crypto and Bitcoin trading, and Bitcoin was recognized as a medium of exchange in Germany in 2013.

All this interest has led to a bustling crypto market — but where’s the best place to buy crypto in Germany?

Since the first acceptance of cryptocurrencies, the cryptocurrency sphere has undergone tremendous upgrades in Germany, including taxation policies. This guide will focus on the state of cryptocurrency in Germany and how you can buy bitcoins.

Germany: A Surprising Crypto Tax Haven

Germany has a unique system of taxing crypto that ensures crypto assets have a satisfactory tax treatment. Sales below €600 are tax exempt, and that includes crypto profits and transactions.

Another vital aspect of the taxation of crypto in Germany is that if individuals hold their crypto for over one year, any proceeds from selling these assets after the year are entirely tax-free. However, under the income tax act section 23, crypto held for less than a year will remain subject to income tax if they make any profits.

Taxation on Crypto Transactions for German Retail Investors

Businesses and companies in Germany also enjoy unique crypto taxing systems. The use of crypto assets to pay for other goods purchased is considered a bitcoin sale. These kinds of transactions are commonly called speculative or private sale transactions.

If the Bitcoin will be held for more than one year, then the entire traded amount is exempt. However, if the crypto is held for less than a year, the retail business will receive a tax exemption of €600. The taxable gains are found by deducting the sales price from the costs used in acquiring the BTC used. In case of losses in the deductions, they will be offset against future gains.

How Can I Pay for My Crypto?

When you want to purchase crypto, the first step is often getting the right exchange platform with the most reliable fees. After creating an account, you can speculate on the market to get the right price for your asset.

Often the payment method differs from the exchange platform. However, the following methods may apply in Germany;

- Use a debit or credit card

- Use the BTC ATM where you put your cash and receive BTC in return

- Crypto broker accepting cash deposits

- Buy bitcoin using a PayPal account

- Pay for crypto with monies from your bank account

- Pay for crypto using other cryptos

Top Cryptocurrency Exchanges to Buy Crypto in Germany

1 CryptoWallet.com #1 Recommended

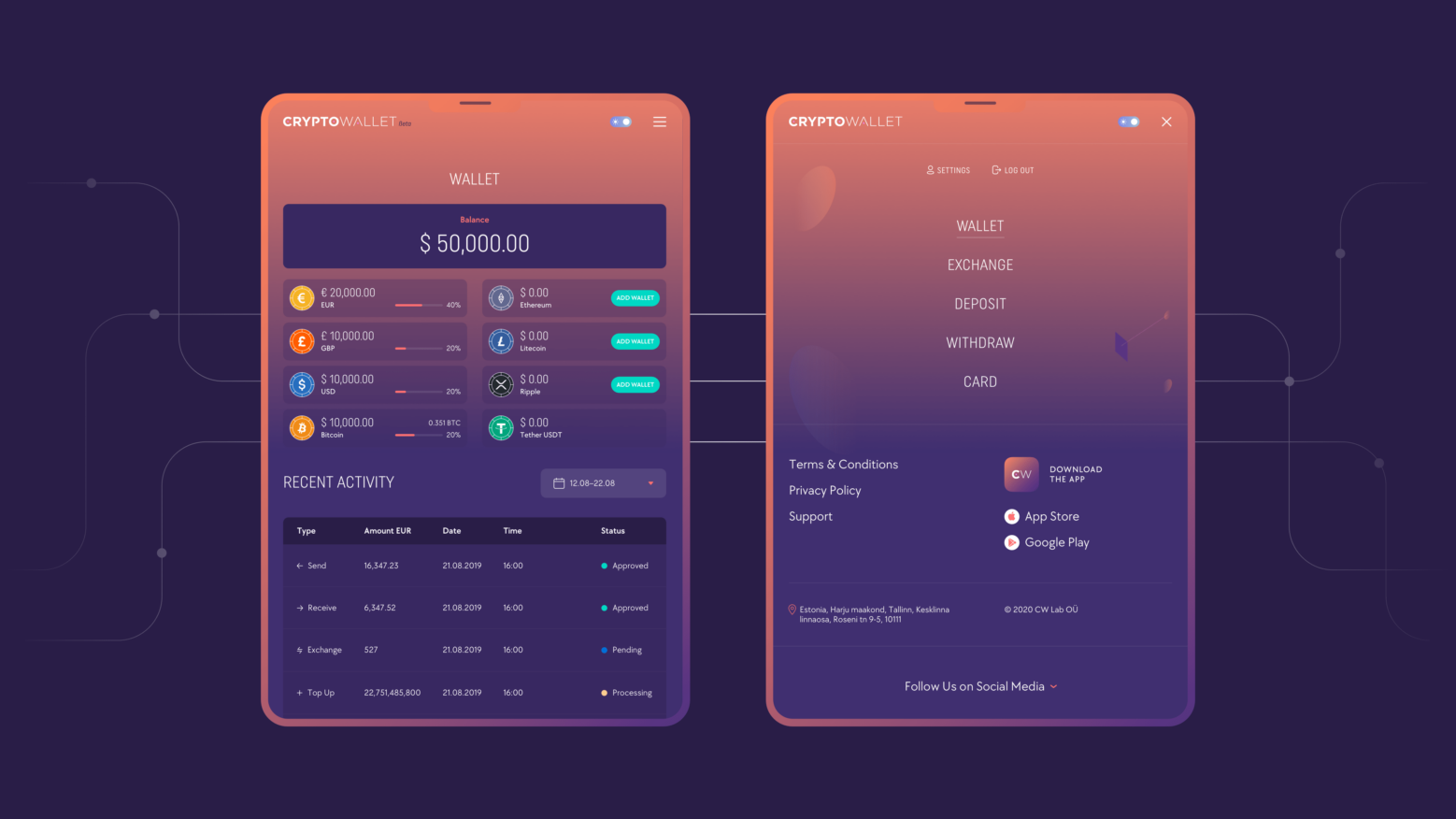

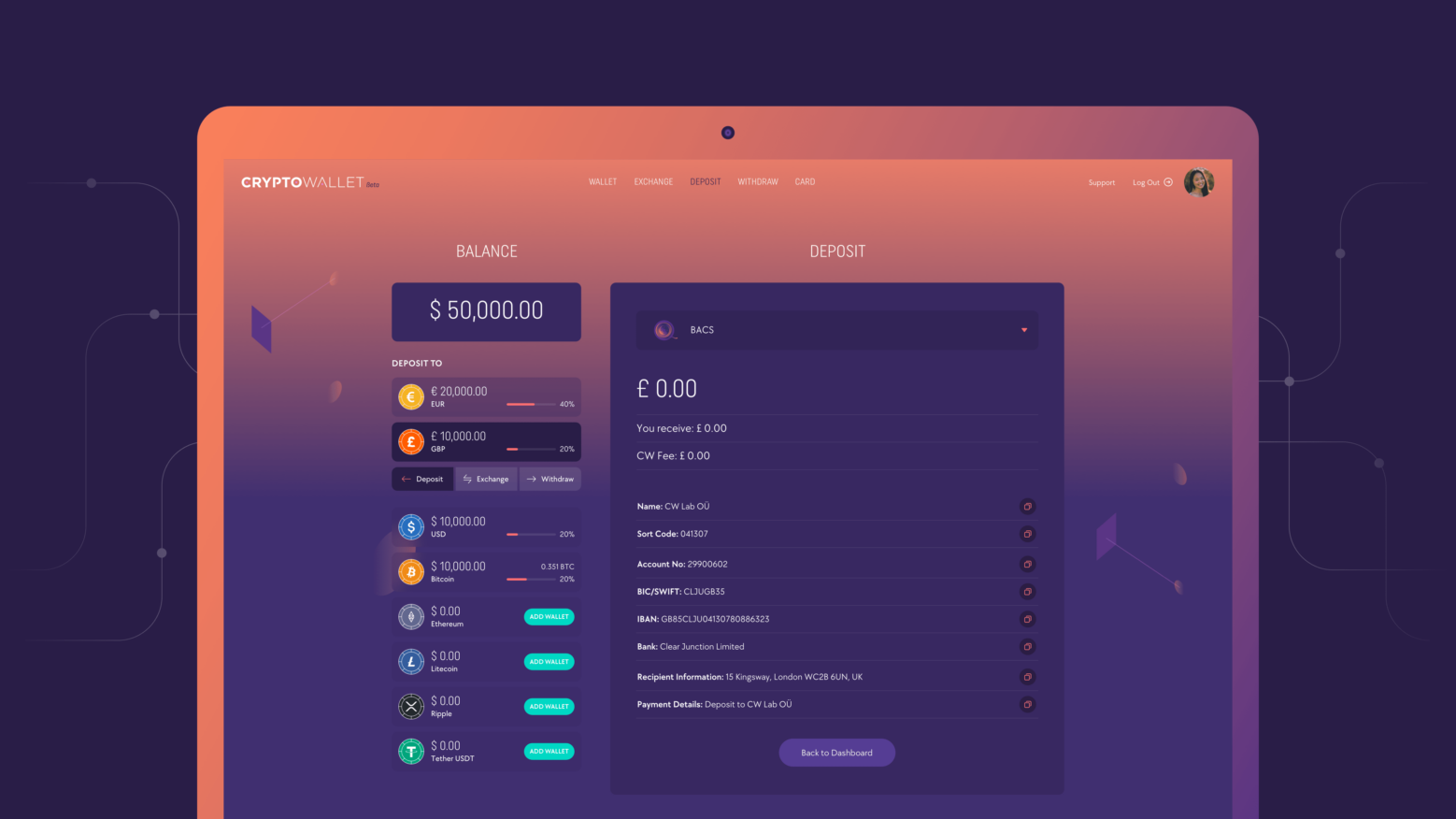

There are various platforms in Germany where you can buy crypto assets easily. We’d like to start by highlighting our own service, Cryptowallet.com.

CryptoWallet.com designed is a complete crypto-banking service that allows you to buy and sell 5 major cryptocurrencies and even spend them in stores as real money! To order your very own crypto debit card, download the CryptoWallet.com app.

2 Binance

Binance is regarded as the largest crypto exchange platform providing top services like crypto exchanging, P2P trading, Margin trading, spot trading, etc. The platform is highly user-friendly and utterly convenient to users. Moreover, signing up on the platform is relatively effortless, involving just a few steps.

Binance has a 0.1% flat rate for spot trading, and the maker and taker fee is 0.02% and 0.04%, respectively. Depositing is free. It is also a reputable platform, owing to its large number of users and many other services it has released, including a wallet, BSC, etc.

Pros (What We Like)

- Supports over 200 crypto assets

- Available in all countries globally

- High reliability owing go its products the BSC, etc

- Great cluster support

- Supports multiple payment methods, including credit/debit cards, bank transfers, and SEPA

Cons (What We Don’t Like)

- Some reviewers suggest that the customer assistance has lots of delays

- Impossible to deposit using traditional methods like

3 eToro

eToro is a less popular Crypto exchange network providing world-class crypto and fiat exchange services in over 100 countries globally. Currently, the platform serves millions of users efficiently. Verification is mandatory in eToro requiring the user to provide proof of identity and proof of address.

The platform’s design is easy to work with, even for beginner traders. However, the platform has very complex trading fees, depending on the financial instrument in use. There are different fees charged depending on the Crypto asset chosen, i.e., 0.75% for BTC and 1.9% for ETH.

Pros (What We Like)

- Supports a vast number of investment options in fiat and crypto

- The transactions charges are fluctuate depending on the choice of asset

- Has long term trust being in operation since 2007

- Top usable UI

Cons (What We Don’t Like)

- Accused of several insecurity issues, although not proven beyond reasonable doub

- Supports very few Crypto assets when compared to its competitors

4 CEX.io

Founded in London in 2013, CEX.io has been providing excellent crypto services. It started with cloud mining services but later transformed to major in exchange services in 2015. Currently, CEX.io offers crypto exchanging services to just a few Crypto assets, including BTC, BSC, and several others. It accepts many payment options, including Visa, Mastercard, etc.

According to many users, the platform is quite user-friendly both for mobile and desktop. The transaction fees in Cex.io depend on the trade volumes. However, the fees begin from as low as 0.1% and 0 for takers and makers, respectively. Deposit and withdrawal fees are charged depending on the withdrawal method.

Pros (What We Like)

- High-level security

- User-friendly UI

- Good mobile application

- Multiple payment methods

Cons (What We Don’t Like)

- High fees

- Few coins supported

5 Bitcoin.de

Bitcoin.de is a German-based bitcoin marketplace assisting investors to buy and sell BTC at great prices. This platform does not function like regular exchange platforms; instead, it works like eBay, an intermediary between buying and selling BTC.

Bitcoin.de is also user-friendly, with the dashboard making it easy to find buyers and sellers by placing bids in EURO. The trading fees at Bitcoin.de are about 1% of the transaction value, divided between the buyer and seller. Verification in this platform is done for bank accounts, and other security protocols like 2FA and google authentications are present in the system.

Pros (What We Like)

- It offers high transparency with its partnering with the famous Fidor bank

- Highly regulated

- It has a 24/7 support system

- Has high security with 2FA instilled

Cons (What We Don’t Like)

- Only BTC supported

- Only EURO fiat supported

6 Coinmama

Currently supported in over 180 countries globally, the Israeli-based exchange is another excellent option for German investors. Coinmama has been able to garner followership of over 2 million people since its launch.

Verification in Coinmama is simple; you need to upload your ID or passport and then take a selfie holding the ID. It can take hours for the verification to complete, but the wait is worth it. However, Coinmama charges super-high fees . For instance, there is a transaction fee of 5.5%. Also, most of all transaction fees, including credit card fees, range between 5 and 5.5%. Costs are paid in USD or EURO.

Pros (What We Like)

- Top security

- Highly user friendly

- 24/7 assistance

- Available globally

- Accepts debit and credit cards

Cons (What We Don’t Like)

- No direct phone assistance

- Very few crypto assets supported

- High Fees

7 Safello

Safello is a Sweden-based crypto exchange platform providing its users with the ability to buy and sell bitcoins. This platform is limited to operation in Europe only, and it aims to foster speedy transactions to hedge against market volatility. This platform is quite simple, with straightforward features and a great and user-friendly UI.

The transaction fees range between 0.1-0.5 depending on the volume of the transaction. The deposit and withdrawal fees range between 0.1-0.29% and 0.3-0.49%. When it comes to verification, the platform collaborates with Jumio to provide instant ID verifications to users. It also has 2FA for even further authentication.

Pros (What We Like)

- Stores funds in cloud storage options to bolster security

- Very easy to sign up

Cons (What We Don’t Like)

- The fees are different depending on transaction type and volume

- Cannot deposit fiat with credit cards

8 LocalBitcoins

LocalBitcoins is a peer-to-peer bitcoin exchange platform allowing persons to complete face-to-face and internet-based transactions. It has an escrow service for the security of investors’ funds. Signing up for the platform takes 20 seconds, and the platform works superfast. The entire platform is highly user-friendly and spot-on.

Since it respects anonymity, the platform does not ask for beginners. However, as you continue trading and climb across the tiers, the platform sets, you undergo different verification procedures. All trades undergo a 1% trading fee, and the selling parties pay the fee.

Pros (What We Like)

- Supports many payments methods

- Accessible almost everywhere globally

- Works at fast speeds

- Super easy to use

Cons (What We Don’t Like)

- Requires high vigilance

- Supports BTC only

9 Kraken

Kraken is another one of the best crypto exchanges in the crypto business today. It allows users to exchange cryptos for the seven fiat currencies supported. Moreover, Kraken currently supports over 50 crypto assets and 176 countries.

The platform is user-friendly for both experienced and rookie crypto traders. Kraken also has fair withdrawal fees charging around 0.0005 for BTC and 0.005 for ETH. The platform has a fee schedule that differs depending on the asset type and the volume of trade. Furthermore, it takes security very seriously by leveraging proof of reserve audit systems for ultimate security.

Pros (What We Like)

- Secure

- Support many crypto assets

- Highly reliable

Cons (What We Don’t Like)

- A complex fee schedule, although sometimes the fee is fair

- The custom assistance and service is wanting

10 OkCoin

OkCoin is one of the oldest crypto exchange platforms in the world. Although it has been in the market for a long time, it supports very few crypto assets. Many customers still complain about the platform’s user-friendliness; however, you can try it to see. The trading fees depend on the value of transactions, with the lowest takers and makers fee standing at 0.02% and 0.00%, respectively.

The platform has verification in two levels, Level 1 and 2. In level 1 verification, only details like name, nationality, ID or passport number, address, and name are needed. For level 2 verification, a user must upload the passport or ID and other documents like utility bills and residence proof.

Pros (What We Like)

- Top liquidity

- Low fees

- Easy to deposit and withdraw in fiat

Cons (What We Don’t Like)

- The verification is high even for withdrawal

- Very few assets supported

German Crypto Exchange FAQs

What is the price of Crypto in Germany?

Bitcoin and crypto prices in Germany are the same as in any other place. These prices depend on the prevailing market conditions. It’s up to you to identify the best exchange with favorable conditions. Moreover, to get digital assets at a good price, you can analyze the market then make your final investment decision.

How Do I Transfer Crypto That I Have Purchased?

You need to possess a crypto wallet like Cryptowallet.com, where you can store your coins. When exchanging, you send to another person’s wallet using the keys. Therefore transferring the coins is easy when you have the recipient wallet key.

How can I pay for my Crypto?

There are multiple ways to pay for crypto in Germany, including Bank accounts, MasterCards, Cash, use Escrow services, etc. However, depending on the exchange platform involved, the fee will vary from one payment to another.

How to buy Crypto in Germany

To buy Crypto in Germany, you need to have access to a reliable wallet for crypto storage and an exchange platform or marketplace where you can get the crypto at reasonable prices.