How to Buy Crypto in Canada

Canada is a thriving crypto market, with a growing number of investors interested in Bitcoin, Ethereum, and other cryptocurrencies.

It’s perfectly legal to invest in crypto as a Canadian resident. However, seeing as crypto is not classed as legal tender in Canada, it’s important to be aware of the tax liabilities as well as the best ways to buy digital assets in Canada.

How to Buy Crypto in Canada

Buying crypto in Canada is easy. We’ve made a detailed guide including the history of crypto in Canada, tax rules and regulations, and a ranked list of exchanges where you can buy crypto.

The History of Crypto in Canada

Cryptocurrencies were invented with the creation of Bitcoin in 2009 by an anonymous developer or team of developers called Satoshi Nakomoto.

The first Bitcoin ATM was launched in Vancouver in 2013, allowing users to pay cash for Bitcoin for a higher premium than the market price. Canada has one of the highest numbers of BTC ATMs to this day, although we recommend using an exchange for better prices and customer support.

While Canadian regulators have been somewhat receptive to cryptocurrencies, high-profile events such as the 2019 Quadriga X exchange security breach in which $190 million CAD was lost have obliged the government to keep a close eye on how the trade of crypto assets is handled in Canada.

How Tax Rules Apply to Crypto Currencies

In Canada, crypto is taxed as income tax when received as payment for services, or as capital gains tax when sold for a profit. 100% of business income is taxable, while up to 50% of capital gains tax is taxable.

Tax events include:

- Gifting or selling crypto

- Trading crypto for other cryptos

- Using crypto to buy goods or services

Let’s take a look at where you can buy crypto as a Canadian resident.

Where to Buy Crypto in Canada

1 CryptoWallet.com #1 Recommended

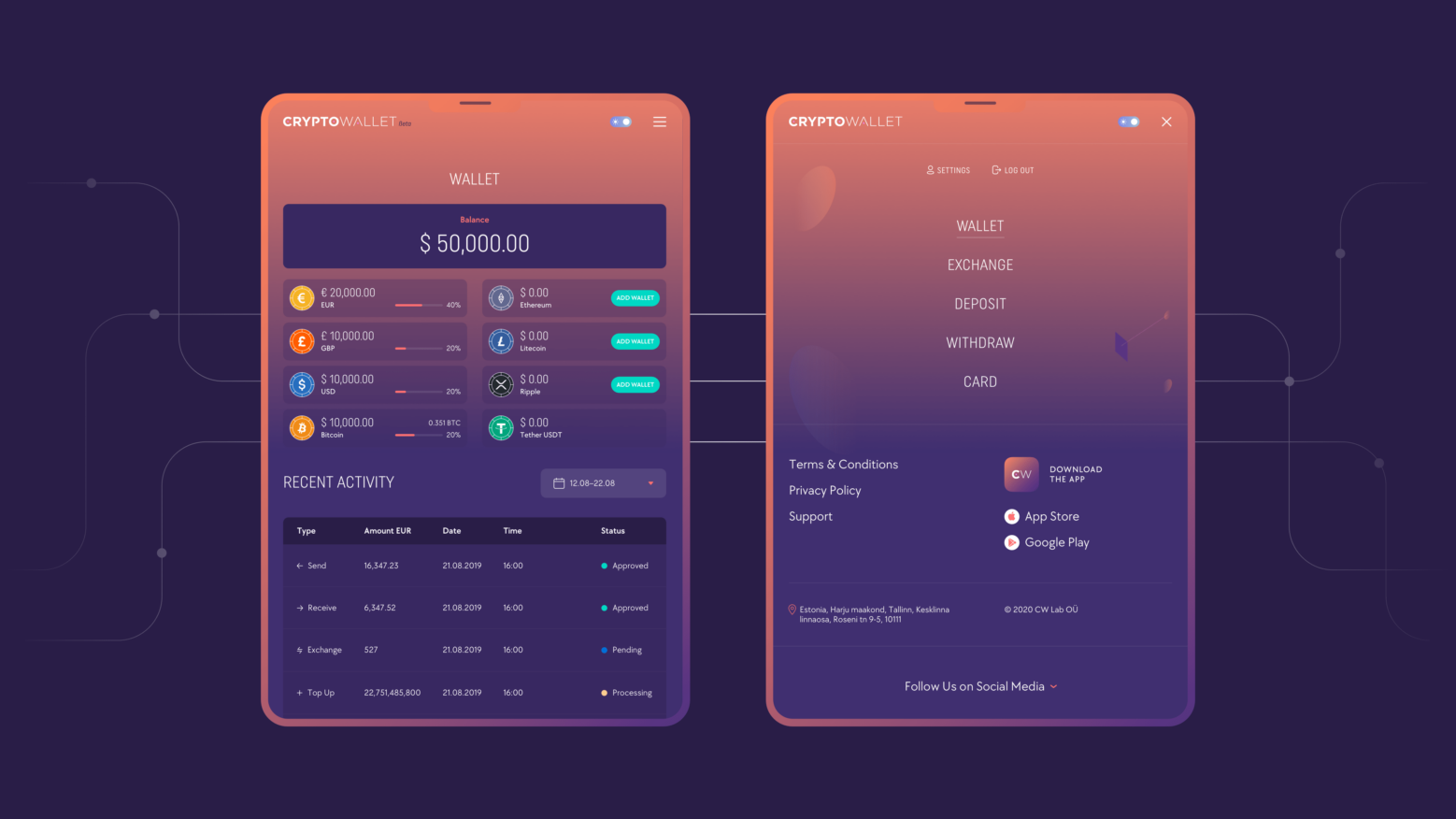

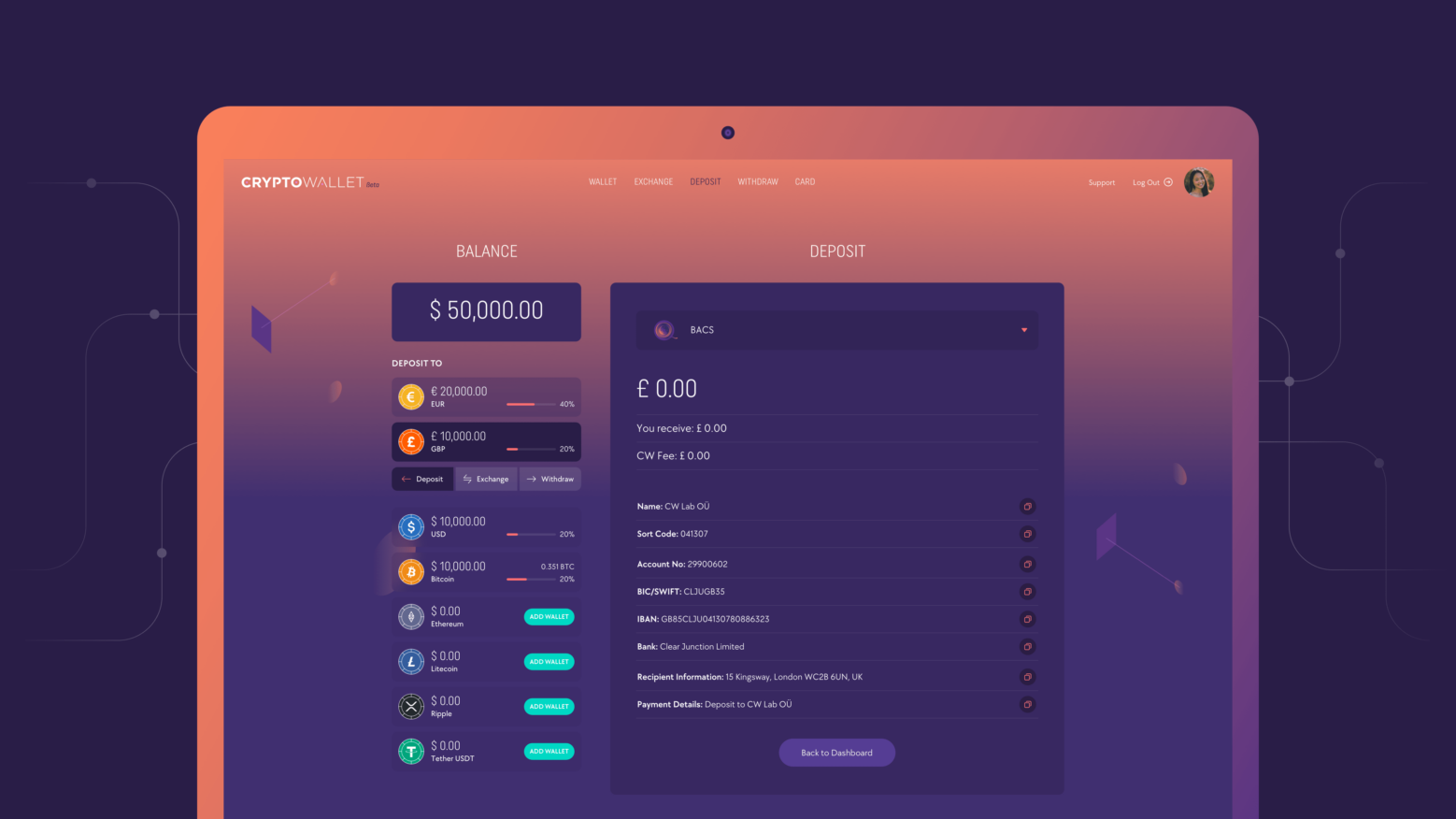

Before we begin, we’d like to highlight our own offering, which is much more than just an exchange. Crypto Wallet is an all-in-one crypto banking solution that allows you to buy, sell, earn, and even spend crypto assets as real money.

Users can buy Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Tether (USDT) on Crypto Wallet using fiat currencies like the EUR and GBP, or with other cryptos.

You can order a crypto debit card that allows you to spend crypto in any store or online, finally letting people use digital assets as real money. If you sign up new users, you’ll earn a percentage of their debit card transaction fees.

We offer users their own international bank account numbers (IBANs), and you can use crypto to pay your bills directly from the account if you like.

If you’d like to use these services or learn more about them, download CryptoWallet.com now!

Let’s look at some other ways you can buy crypto like Bitcoin and Ethereum in Canada.

2 Bitbuy

Bitbuy is a Canadian crypto company available to Canadians only. It was launched as Instabit in 2013 and offers 7 popular cryptocurrencies with competitive fees. Storage of all these cryptos is possible in the exchange’s digital wallet.

- Ease of Use: Easy

- Available Currencies: BTC, BCH (Bitcoin Cash), EOS, ETH, XRP, LTC, and XLM

- Fees: 0.0005 Withdrawal Fee, 0.10% Taker Fee, 0.10% Maker Fee (market maker).

- Pros & Cons: Many other exchanges offer a wider range of cryptocurrencies, so your use of Bitbuy will depend on whether the other features appeal to you. The low fees are a big plus, and Bitbuy also has an OTC desk that offers over-the-counter trades for larger sums with quick settlement.

3 Netcoins

Netcoins is a low-fee exchange company that supports seven different cryptocurrencies as well as Canadian dollars and US dollars.

- Ease of Use: Very easy

- Available Currencies: BTC, ETH, USDT, BCH, LTC, XRP, QCAD

- Fees: 0.5% per trade, no fees for deposits or withdrawals

- Pros & Cons: Get verified in minutes. You can fund your account with digital currencies, Interac e-Transfer, online bill payment or bank wire transfer. Limited pairs and trading options, but low fees and no hidden fees.

4 CoinSmart

CoinSmart is a Canadian exchange with 7 supported digital currencies along with CAD support. It was the first exchange to offer a CAD/XMR (Monero) pair. Suitable for experienced investors as well as beginners for a varied trading experience.

- Ease of Use: Intermediate

- Available Currencies: BTC, ETH, XLM, LTC, XMR, BCH, DASH

- Fees: 0.3% flat rate on fiat/crypto trades, 0.6% on crypto/crypto, 2.5% for bank draft deposit, 1% wire transfer, 2% processing fee for CAD withdrawals, and 10% for credit card purchases.

- Pros & Cons: Some of the lowest trading fees of our listed exchanges, although the extremely the high credit card purchases fee makes the credit card funding option essentially unusable.

5 Coinberry

Coinberry is a crypto exchange available to Canadian users only. The exchange is registered with FINTRAC, Canada’s financial intelligence unit.

- Ease of Use: Intermediate

- Available Currencies: BTC, ETH, LTC, XRP, BCH, XLM

- Fees: 0.5% to 1% per trade

- Pros & Cons: Minimum deposit of $50 CAD, and wire transfers reportedly suffer delays from time to time. FINTRAC registration ensures regulatory compliance, and the exchange charges no fees for deposits or withdrawals.

6 Coinsquare

Coinsquare is a Canadian Bitcoin exchange that started out trading Bitcoin only and recently branched out to offer more fiat/crypto pairs.

- Ease of Use: Easy

- Available Currencies: BTC, ETH, LTC, BCH, DOGE, DASH, XRP, XLM

- Fees: 0.1% maker fee (trades queued up in order book), 0.2% taker fee for BTC pairs (instant market order). 0.4% maker fee for crypto pairs not including Bitcoin. 10% credit card funding fee, Interac e-Transfer, bank draft, Flexepin, money order, and wire transfer fees are 0% for cash payments.

- Pros & Cons: Again, credit card fees are so high that the credit card funding option is impractical, and there are limited trading pairs, but with no fees for other deposit methods and low trading fees, Coinsquare appeals to many Canadian traders.

7 MyBTC.ca

MyBTC.ca is a Bitcoin online exchange suitable for beginners thanks to its transparent fee structure and easy interface, and a diverse range of payment methods including Interac E-Transfer. However, the Bitcoin exchange is for buying Bitcoin only, with no other digital currencies available for cryptocurrency trades.

- Ease of Use: Easy

- Available Currencies: BTC

- Fees: No withdrawal fees or trading fees. 4.75% bank wire, 9.75% credit card funding fee, 7.75% Flexepin, 7.75% Interac E-transfer.

- Pros & Cons: Instant sales. The MyBTC Bitcoin exchange only sells Bitcoin for CAD, with no other supported currencies for trading. While deposit fees are high, the fact that Bitcoin exchange users can buy BTC instantly and easily without wondering about hidden fees makes it a straightforward investment option for beginners.

8 Coinmama

Coinmama is an Israeli cryptocurrency exchange that supports 8 digital currencies as well as fiat currency. Users can trade cryptocurrencies and buy Bitcoin with more than one funding option, including credit or debit card, bank transfer, PayPal, or Apple Pay. The site offers limited education for investors, unlike most which offer blog resources and self-help tools for Bitcoin buyers.

- Ease of Use: Easy

- Available Currencies: BTC, BCH (Bitcoin Cash), ETH, ETC, ADA, LTC, XTZ

- Fees: Up to 3.9% for buys, up top 4% for sells

- Pros & Cons: Diverse range of cash deposit options and lots of investment options and payment options, but no Interac E-Transfer, and users face high fees per transaction compared to many crypto exchanges.

9 Kraken

Kraken is a U.S. Bitcoin exchange and one of the largest cryptocurrency exchanges in the world, with a wide selection of digital currencies. User accounts are insured, offering an added layer of security, and the exchange publishes helpful trading guides and research. Users can deposit funds via bank or send existing crypto funds.

- Ease of Use: Intermediate

- Available Currencies: 40 different currencies and multiple fiat trading pairs

- Fees: Fees can drop to 0.9% when users buy stablecoins with fiat currency. Kraken charges 1.75% for other crypto pair trades, 3.75% for card transactions, and 1.7% for bank transfers.

- Pros & Cons: Lots of investment options appeal to those who wish to trade in various altcoins, and it offers more advanced trading tools than some crypto exchanges for the more experienced trader. Fees are higher than some of the other exchanges on this list.

FAQs

Is Cryptocurrency legal in Canada?

Yes, crypto is legal in Canada and classified as a form of property rather than legal tender (legal tender typically refers to fiat money such as CAD).

Do Canadian banks accept crypto?

Yes, several banks including the Royal Bank of Canada, TD Bank, and Scotiabank support Bitcoin and crypto purchases among other investment options.

Is Coinbase legal in Canada?

Yes, the Coinbase Bitcoin exchange is legal in Canada and Canadian investors can trade on that cryptocurrency trading platform along with the other online platforms listed in this article.

What happens if I invest $100 into Bitcoin?

Nobody can reliably predict Bitcoin price movements. However, you can invest $100 in Bitcoin using Crypto Wallet and then either store the Bitcoin, trade it, or even spend it online and in stores with our crypto debit card! Download Crypto Wallet here.

Is it a good time to invest in crypto 2021?

It’s still early days for cryptocurrencies and crypto exchanges, meaning there will be plenty of new opportunities for new investors. Whether you’re a professional trader or a beginner, you can invest in crypto by downloading Crypto Wallet!